Big Picture

2023 was our fifth consecutive comeback year — both financially (our budget has doubled since 2018) but also very much momentum-wise on our work. We added three new research positions; they enabled us to increase our visibility protecting public education, documenting corporate misconduct, pushing for transparency and accountability reforms, and revealing more explicitly how subsidies exacerbate racial inequities.

We trained in person in California, Florida, Maryland, Massachusetts, Michigan, Missouri, Nevada, New York, Ohio, and Washington, D.C. and virtually by Zoom dozens of times across the country to grassroots groups, non-profit organizations, pop-up coalitions, journalists, educators, school boards and others, to show the vast capacity of our databases and how to put our tools into action.

Protecting Public Education

A wonky-sounding accounting rule that took effect in FY 2017 has become a powerful new tool for defenders of public education.

Thanks to Governmental Accounting Standards Board (GASB) Statement No. 77, the public is seeing, for the first time ever, how much tax revenue communities lose to corporate giveaways. This is especially true for school districts, which lose the most yet usually have no say in tax abatement giveaways.

Throughout 2023, we used the rule to great impact:

In New York State, we proved that public schools lose at least $1.8 billion per year to corporate tax abatements. The costs in some places are unfathomably high: Seven school districts lost more than $5,000 per pupil per year! Fifteen more lost between $2,000 and $5,000 per student per year. And another 15 lost between $1,000 and $2,000. All told, 37 New York State school districts lost more than $1,000 per student per year.

IMMEDIATE IMPACT

In response to our findings, a bill to shield school property taxes from abatements has been introduced, with the support of senior legislators, the NYS school boards association, superintendents association, parent-teacher association, teachers union, AFL-CIO, good-government groups, education-defense coalitions, budget watchdogs, and state council of churches.

In Cincinnati, we painstakingly revealed how Cincinnati Public School (CPS) lost $80.9 million in the past six fiscal years to tax abatements – $2,394 per student. Both absolutely and on a per-student basis, CPS losses are greater than those of the eight largest suburban school districts in Hamilton County.

In St. Louis, Missouri, as the year drew to a close, we prepared to deliver a third study right after the holidays revealing that students there each lose $1,645 per year. Looking metro-wide at 24 school districts, we found sharp racial disparities, as well as inequality based on income and disability.

In each study, we recommended: leave the children’s money alone.

Our Databases

In July 2022, we launched a “freemium model” of our popular Violation Tracker and Subsidy Tracker databases. Though the databases remain free to use and search, downloading data requires a subscription (which starts at just $25 a month!).

We are pleased to see how many academics, investors, regulatory agencies, consultants, and law firms recognize the value of our flagship databases, which we improve every month. This user-fee support helps ensure the future of these critical, labor-intensive tools.

Combined, we added over 125,000 records in 2023 to these two databases.

Meanwhile, our four other databases remain entirely free, even to download.

![]() Tax Break Tracker, our database chronicling how much revenue governments forego to corporate tax abatements, continues to be a great resource for communities looking to see where their money has gone. We annually update the foregone revenue for each state’s five biggest cities, counties, and school districts, along with the states themselves, so users can start there. For those who live elsewhere, we encourage you to reach out and we can help retrieve information you seek (if it exists!).

Tax Break Tracker, our database chronicling how much revenue governments forego to corporate tax abatements, continues to be a great resource for communities looking to see where their money has gone. We annually update the foregone revenue for each state’s five biggest cities, counties, and school districts, along with the states themselves, so users can start there. For those who live elsewhere, we encourage you to reach out and we can help retrieve information you seek (if it exists!).

![]() Amazon Tracker, our database tracking how much the public subsidizes the $1.76 trillion company, remains one of our most popular resources. While warehouse subsidies are most numerous, Amazon Web Services (cloud computing), got the biggest package in the company’s history last year: $1 billion for a data center complex in Morrow, Oregon.

Amazon Tracker, our database tracking how much the public subsidizes the $1.76 trillion company, remains one of our most popular resources. While warehouse subsidies are most numerous, Amazon Web Services (cloud computing), got the biggest package in the company’s history last year: $1 billion for a data center complex in Morrow, Oregon.

The rise of artificial technology means accelerating growth of energy-hogging data centers, and internet giants will keep expecting more tax breaks and electricity discounts, which some states fail to even price-tag. Throughout 2024, we’ll be tracking and posting all that news.

CHIPS Communities United

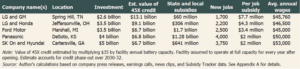

As the U.S. embarks on the most massive experiment in industrial policy in its history, Good Jobs First partnered with the Communications Workers, Jobs to Move America, United Auto Workers, the International Campaign for Responsible Technology, and others to launch CHIPS Communities United.

This network of national experts, with centuries of expertise watchdogging the toxic, anti-union semiconductor industry, is supporting local coalitions to avoid a replay of Silicon Valley’s record EPA Superfund dumping. Together, we’re advocating for equity, good jobs, community benefits, and state of the art workplace and environmental safeguards in the communities where new microchip fabrication factories benefit from the CHIPS and Science Act.

As part of that effort, we were one of the first to write about a provision in the CHIPS Act – the Advanced Manufacturing Investment Tax Credit (a.k.a. the 48D tax credit for its section in the Internal Revenue Code) which gives eligible chip makers federal corporate income tax credits they can use or cash out.

The 48D tax credits are extremely generous – 25% of what the companies spend on new manufacturing capacity. We conservatively estimate the 48D credit will cost the U.S. Treasury between $40 billion and $50 billion, far more than the $24 billion estimated by Congress.

Ten chip fabs facilities will receive over a billion dollars each – and that’s before local and state subsidies, which have already run as high as $5.6 billion for one factory!

IRA | Industrial Policy

We also reported on a provision of the Inflation Reduction Act – the Advanced Manufacturing Production Credit (a.k.a. “45X” for its section in the Internal Revenue Code) that will give EV battery companies massive tax credits that they can use or cash out.

The 45X provision, we stated, will cost taxpayers over $200 billion in the next decade, far more than the $31 billion estimated by Congress. Again, this doesn’t include state and local subsidies.

For both 45X in IRA and 48D in CHIPS, despite their astronomical costs, there are no wage requirements for the permanent production jobs that will be created. We’ll be closely tracking semiconductor and EV facilities closely, and pushing for information on which companies are getting how much in federal, state and local subsidies.

Without that critical information, taxpayers can’t evaluate whether these historic industrial policy investments will generate good jobs and boost local economies, or will simply be another windfall for corporate bottom lines.

Corporate Misconduct

This year, we added 32,000 state-level regulatory enforcement actions covering nursing homes to Violation Tracker. An analysis of the data showed that a small group of lesser-known nursing home chains with poor patient safety records are taking over a growing share of the long-term care industry as some of the larger players abandon the business.

Our report, Care At Risk: Upheaval in the Nursing Home Industry, exposed some of the worst actors and offered clear recommendations to help improve the safety and well-being of nursing home residents.

We also added more than 1,400 price-fixing class action lawsuits dating back to the year 2000. We found that large companies operating in the U.S. have paid $96 billion in fines and settlements to resolve allegations of covert price-fixing and related anti-competitive practices in violation of antitrust laws.

Our ensuing report, Conspiring Against Competition, showed how price-fixing by large corporations contributes to inflation.

Approaching $1 Trillion in Penalties

Violation Tracker, our database on corporate recidivism, now contains more than 620,000 cases representing $994 billion in penalties. It remains our global online juggernaut, with 200,000 page views per month. It drives most of our earned income in commercial and academic data licensing and database subscriptions.

A Growing Global Presence

Thanks to the addition of two energetic outreachers, 2023 was our best year yet toward getting more campaigners, journalists, and academics to utilize Violation Tracker UK (United Kingdom).

Launched in October 2021 with 63,000 entries from around 40 sources, we now have 102,000 entries from more than 70 regulatory agencies. And researchers Phil Mattera and Anthony Baggeley have been able to update the database monthly instead of quarterly.

Violation Tracker is also gaining more media citations, more use by NGOs, and even the start of earned income.

At least three of the blogs written by our new outreachers became mainstream news stories: on the Environment Agency’s decline; the rise of corporate nurseries (see image); and recidivists on the Prime Minister’s Business Council.

Violation Tracker Global

In 2024, we will continue to explore launching a third version of Violation Tracker, this one focused on tracking the behavior of the largest, more harmful multinational companies globally.

Exposing Racial Inequities

In 2023, we also launched a quarterly series of reports looking at the relationship between race, ethnicity, and economic development. Our goal is to be more explicit about who really wins from the ways “economic development” is currently being done across the country.

Our first piece looked at the biggest 50 subsidy deals in history, noting that white people led all but 12 of the companies that received the taxpayer packages. Of the 12 none-white CEOs, none was born in the U.S.

We documented what we called the “reparative benefits” that Black and Brown students are experiencing in Louisiana, thanks to hard-won reforms to the nation’s most notorious property tax abatement program.

More than $282 million in new revenue is already flowing each year to Louisiana public services, with school districts as the big winners – especially in “Cancer Alley” parishes with majority-BIPOC student bodies.

In our final report of the year, we revealed details of a sales and property tax exemption that costs Michiganders hundreds of millions of dollars every year in foregone revenue. The tax savings from these exemptions — for pollution control equipment — have, incredibly, primarily enriched some of the state’s worst repeat polluters, including DTE Energy. They have harmed some of the poorest places in the state, which not by accident also have high populations of people of color.

Good Jobs First Turns 25!!!

We started Good Jobs First with the goal of creating a fair, transparent, and people-centered economy. Corporations – many of which have extensive records of workplace misconduct – receive massive subsidies behind closed doors.

On July 13, 2023, we turned 25! We partnered with Social Movement Technologies to create a series of videos celebrating the milestone. Check them out on our YouTube channel.

And we put together 25 of our milestones.

In an open call, we asked people we’ve worked with or those who have used our data to fill in “If Good Jobs First did not exist, we would…”

Here are some of those responses:

|

|

|

|

|

|

|

|

2024: Plans and Priorities

We started 2024 with a bang, already releasing reports on the harms of tax breaks in St. Louis, the whiteness of state privatized economic development boards and the alarming growth of tax breaks in data centers.

We have big plans for 2024: more watchdogging of the IRA and CHIPS and Science Act acts to ensure workers share in the fruits of the labor that will drive these projects; more help for education equity activists protecting public schools; and more trainings to teach people how to activate our tools and data for justice.

We have big plans for 2024: more watchdogging of the IRA and CHIPS and Science Act acts to ensure workers share in the fruits of the labor that will drive these projects; more help for education equity activists protecting public schools; and more trainings to teach people how to activate our tools and data for justice.

We come into 2024 with our biggest staff and our largest budget ever. We believe that our growth reflects the times coming to us. Our dogged, laser-focused work “following the money” in development subsidies and regulatory penalties is paying off.

We’re here to help, and we look forward to meeting many more of you this year.

Together, we can build an economy for us.