This holiday season, semiconductor manufacturers have a lot to be thankful for.

Under a provision of the CHIPS and Science Act, factories making semiconductors will receive billions of dollars from the U.S. government. Thanks to the Act’s Advanced Manufacturing Investment Tax Credit, also called the 48D tax credit for its section in the Internal Revenue Code, chip makers are eligible for federal corporate income tax credits they can use or cash out.

The CHIPS Act is designed to boost national security and bring manufacturing jobs to the US. But our research indicates taxpayers could be paying billions of dollars more than previously understood to enrich already wealthy corporations.

The 48D tax credit is very generous – 25% of what the companies spend on new manufacturing capacity. By contrast, the federal tax credit for research and development is 6% of qualified expenses. We conservatively estimate the 48D credit will cost the U.S. Treasury between $40 billion and $50 billion, far more than the $24 billion initially estimated by Congress’s Joint Committee on Taxation. Ten manufacturing facilities will receive over a billion dollars each.

This windfall for semiconductor manufacturers is above and beyond the Act’s $39 billion CHIPS Incentives grant program and the $13 billion “Hubs of Innovation” program that will feed companies’ talent pipelines. And it doesn’t include another $15 billion in state and local subsidies to the same corporations.

Because the 48D credits are “as of right,” their costs will not be disclosed publicly, and neither will the names of recipients. Semiconductor manufacturers won’t have to apply for them; they’ll just claim the credits on their federal tax returns, which the IRS holds in secret.

As of August 2023, the Semiconductor Industry Association had mapped $227 billion in spending on new or expanded facilities for microchip manufacturing, while the White House cited $231 billion in new investment. Not all of that spending will qualify for the 25% tax credit, but it is clear the combined tax credits for these investments will far exceed the $24 billion allocated by Congress and outstrip the better-known CHIPS Incentives grants.

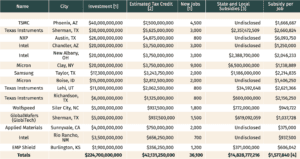

The cost to the taxpayer is astounding – over a million dollars per job for the top dozen. For example, NXP Semiconductor’s planned expansion in Austin could yield $4.9 billion in federal tax credits for just 800 new jobs, which could cost taxpayers over $6 million for each job created.

To be sure, these numbers are estimates. Some share of companies’ investment spending will not be eligible for the tax credit, like building and outfitting office space for administrative work. But given the astronomical cost of semiconductor manufacturing equipment, it is likely that the vast majority of these projects’ overall costs will qualify for the tax credit. (A single state-of-the art extreme ultraviolet lithography machine, which is used to make the most advanced chips, costs more than $300 million.)

The Taiwan semiconductor giant Taiwan Semiconductor Manufacturing Corporation (TSMC), which is investing $40 billion in a new plant in Phoenix, Arizona, reportedly anticipates receiving $7 billion to $8 billion in tax credits, suggesting that about 75% of the company’s total investment in the plant will qualify for 48D. Using that back-of-the-envelope metric, all new chip fabs announced so far will cost the federal government about $45 billion in tax credits.

On the other hand, the total cost of 48D may well be higher than our estimate. The 48D credit is available for projects that break ground by New Year’s Eve 2026, so companies still have three years to qualify. It’s quite likely more will: the Department of Commerce’s CHIPS for America office has more than 460 applications on file. The data we use is conservative: it assumes Micron and Intel can claim tax credits on $20 billion in investments for their new fabs in New York and Ohio, but both companies have announced plans to spend $100 billion on their respective factories.

On top of federal 48D and the CHIPS Incentives grants, factories manufacturing microchips have been awarded over $15 billion in state and local economic development subsidies in just the past year.

For example, the new $30 billion Texas Instruments plant in Sherman, Texas, will be eligible for up to $5.6 billion in federal 48D credits. Local governments have already awarded it an additional $2.4 billion in tax breaks. The company has promised to create 3,000 new jobs that it says will pay an average annual wage of $48,775. That’s a combined subsidy of $2.6 million per job.

In Clay, New York, a project that Sen. Chuck Schumer credits to his “tireless advocacy,” Micron Corp. will be eligible for $3.75 billion in 48D credits. New York State, Onondaga County, and other local entities have ponied up an additional $6.5 billion for a total package of over $10 billion, or $1.1 million per new job.

In some cases, we don’t know the full extent of state and local spending on the new chip fabs. In Arizona, for example, there is currently no public record of subsidies awarded to TSMC for its massive new Phoenix facility or to Intel, which is building a $20 billion factory in nearby Chandler. Significant public funds are committed to these projects, though we don’t know the price tags. Both new factories sit in a federally designated Foreign Trade Zone, exempting them from state and local property taxes. Under an Arizona law, they will also recoup the sales tax on construction equipment for their facilities, even if the supplies are purchased by contractors. (TSMC is lobbying the state to raise the cap on this giveaway from $100 million to $200 million.)

Here are the 15 largest planned semiconductor fabs, new or expanded, ranked by size of investment.

What will local communities get from companies in exchange for public money? The expensive new jobs don’t come with permanent-job quality requirements, meaning companies do not have to pay market-based wages or benefits to production workers. The semiconductor industry is historically anti-union, and only a handful of U.S. chip fabs have ever been organized.

The new facilities also pose environmental and health hazards, though few people today remember the toxic legacy of Silicon Valley. Despite branding themselves as a clean industry, semiconductor manufacturers use thousands of hazardous chemicals. Over the decades, the industry’s toxic chemical use has harmed workers, their children, and the environment. Before heading abroad to avoid U.S. environmental laws (and expose foreign workers to dangerous conditions), the semiconductor industry left behind 23 poisoned SuperFund sites in Santa Clara County alone – more than any other county in the nation.

Local communities who are enthusiastic about these new businesses would do well to read up on chips factories’ huge water usage, airborne emissions, specialized fire-response requirements, and massive carbon footprints.

That’s why we at Good Jobs First co-founded CHIPS Communities United to help affected communities learn this history and work together to advocate for local needs. We believe the CHIPS and Science Act can be a force for creating good jobs and supporting local economic development, but only if workers and neighbors have a voice in implementation.

In the next few weeks, the federal government will announce the first recipients of CHIPS Act grants. They won’t mention 48D and its beneficiaries. But the investment tax credit deserves our attention. These subsidies are our money, and we can demand that semiconductor companies receiving public funds spend them in ways that benefit workers, communities, and the environment. Then we can all be thankful.