History

Founder and Executive Director Greg LeRoy launched Good Jobs First in 1998 upon winning the Stern Family Fund’s Public Interest Pioneer Award. The Washington, DC-based nonprofit remains the nation’s premiere organization tracking the use of state and local economic development subsidies and chronicling corporate misconduct.

While creating a national consulting practice against plant closings, from Chicago in the mid-1980s, LeRoy began to learn about the massive economic development machine that diverts billions of dollars each year from public services to private companies. He assisted coalitions in several states fighting companies that were moving operations and laying off workers despite having received millions in subsidies.

As the term “Rustbelt” was coined, localities were cutting services or raising taxes despite giving away huge sums of public dollars to companies, even those disinvesting communities.

LeRoy’s deep dives into subsidy abuse led to his 1994 book, No More Candy Store: States and Cities Making Job Subsidies Accountable.

Greg LeRoy in Pittsburgh for a speaking engagement in 2016

Seven years after founding GJF, he followed up with the 2005 book, The Great American Jobs Scam: Corporate Tax Dodging and the Myth of Job Creation, described by Business Week as a “powerful compendium of corporate tax dodging in the U.S.”

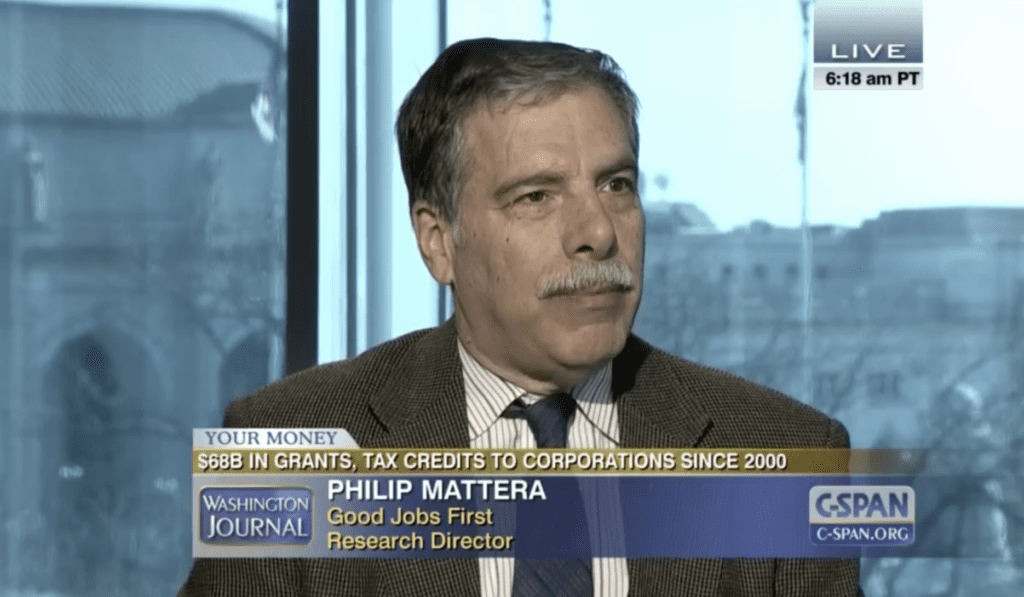

Philip Mattera talks to C-Span following the release of a report about corporations receiving massive subsidies

After Good Jobs First started “naming and shaming” the states for poor disclosure of economic development subsidy outcomes, the number of states disclosing at least some data online jumped from 23 to 37. It also led a project for 16 years in New York City which won two of the nation’s best local incentive-disclosure laws.

In 2001, longtime strategic corporate researcher Philip Mattera joined Good Jobs First as its research director. Mattera led the creation of its first database, Subsidy Tracker, which captures company subsidies from state, local and federal incentive programs, and Violation Tracker, which documents corporate misconduct and has become a globally popular campaign and research tool. And he led the creation of Violation Tracker UK in 2021.

In 2015, State Tax Notes magazine lauded Good Jobs First for perhaps its biggest victory ever: the issuance of Governmental Accounting Standards Board Statement 77 on Tax Abatement Disclosures, which requires states and most local governments to report how much revenue they lose to economic development tax breaks. A landmark in municipal finance, it remains the only kind of tax expenditure ever to be defined and codified by GASB.

Today, the organization is as committed as ever to telling the story of corporate welfare and corporate misconduct, and it actively works with constituency-based groups, public officials, journalists, academics, and others working to build a more equitable and just economy.

Arlene Martínez training journalists participating in the Ravitch Fiscal Reporting program at the City University of New York.

Greg LeRoy answers questions following questions during a presentation at the Lincoln Institute of Land Policy

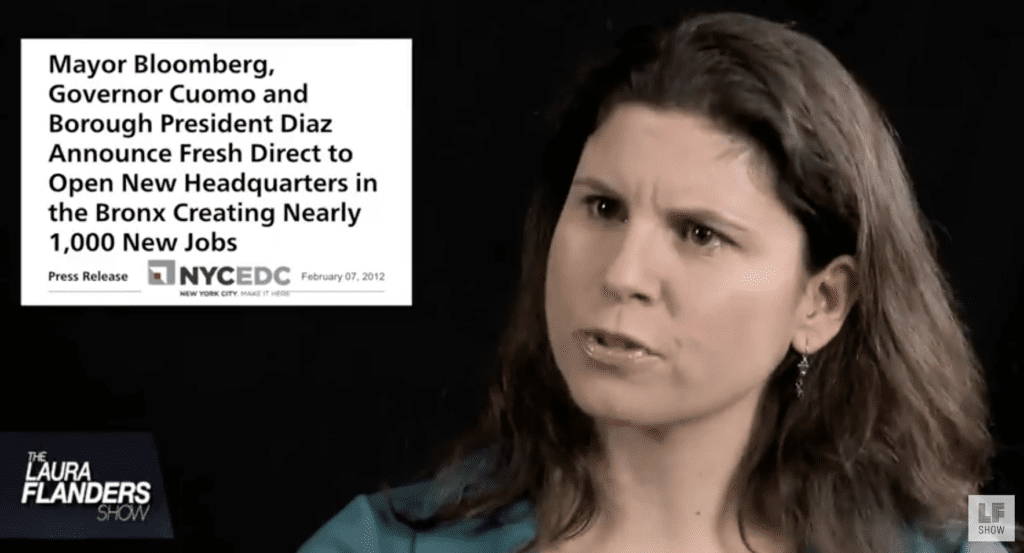

Good Jobs First New York’s Project Director Bettina Damiani explains corporate subsidies are not true economic development

“Good Jobs First” — What’s with our name?

Our name means several things. We are pro-economic development — meaning government has a rightful role in building an economy that addresses the United States’ history of racialized inequality. We believe that good jobs — those that raise working families’ living standards and intentionally benefit historically excluded workers and communities — must be at the heart of any sound development strategy. Incentives cannot be about “Fortune 500 first,” or “capital intensity first.”

Our name means several things. We are pro-economic development — meaning government has a rightful role in building an economy that addresses the United States’ history of racialized inequality. We believe that good jobs — those that raise working families’ living standards and intentionally benefit historically excluded workers and communities — must be at the heart of any sound development strategy. Incentives cannot be about “Fortune 500 first,” or “capital intensity first.”

Whether it’s subsidized job-sprawl, subsidized environmental racism — or subsidized disinvestment of public education, health, or safety — deregulated subsidies only make things worse. Good jobs means fixing development program rules and deals. It also means sound budgeting for public services that benefit all employers and working families — and we know how.

We track regulatory violations because good jobs must also be free of wage theft, discrimination, pollution, safety hazards, contract fraud, and other forms of corporate corruption.

Those are the meanings of our name.