Note: This is the first in a new series of quarterly reports produced by Good Jobs First that look at the relationship between race, ethnicity, and economic development.

The Problem

Economic development subsidy packages to companies can be massive. Thousands of deals totaling up to $95 billion are awarded by states and localities every year to companies both foreign-based and domestic. Large companies dominate the take.

Good Jobs First has a name for the biggest of these – “megadeals” – or workplaces given at least $50 million in state and local tax dollars. In looking at the 50 most expensive of these, several things stand out: Most are multinational companies that answer not to workers or communities but to shareholders – indeed, all but seven are publicly traded companies. And their executive ranks include some of the richest people in the world, who are primarily white men.

When we talk about economic development incentives exacerbating racialized inequality, this is one glaring way. Subsidies transfer wealth from the public to companies led by white male executives.

Summary

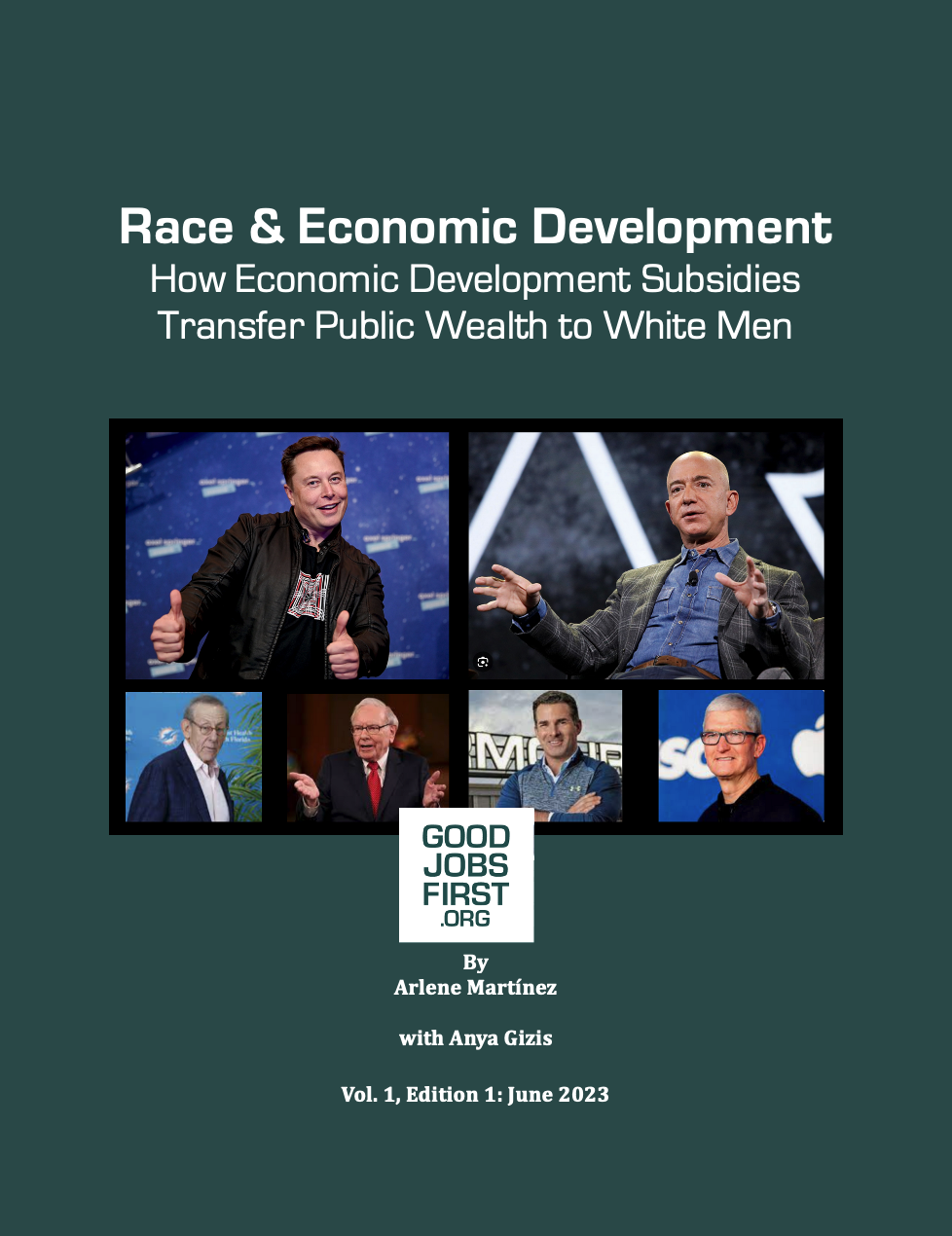

Looking at the leaders of companies that have received the biggest-ever subsidy packages is a Who’s Who of the World’s Richest Men: Amazon’s Jeff Bezos, Tesla’s Elon Musk, Berkshire Hathaway’s Warren Buffet, Apple’s Tim Cook, real estate mogul Stephen Ross, Rocket Mortgage’s Dan Gilbert, and Under Armour’s Kevin Plank.

Good Jobs First analyzed the race, ethnicity and gender of the people who led the 50 companies the year they received the economic development megadeals, ranging in size from $617 million to $8.7 billion for a total of $85,686,093,377.

In all, there are *47 people, since three men – Bezos, Musk, and Boeing’s W. James McNerney Jr. – landed Top-50 megadeals twice. Among our findings:

- White people, including those born in the United States and outside, led all but 12 of the companies (76%). Of those 12 leaders, none was U.S.-born.

- Only two among the group – 4% – were women. Both were white.

- Of the 12 non-white leaders, one was Foxconn’s Terry Gou, who had an estimated net worth of $9.5 billion in 2017, the year his company made the megadeal list; another was Micron’s Sanjay Mehrotra, whose pay in 2022 – the year his company got the No. 2 largest megadeal in U.S. history – was $28.8 million.

- None of the 47 companies was led by an African American.

- These executives were in some cases paid significantly more than front-line employees. Apple’s Tim Cook made $98.7 million in 2021, a wage 1,447 times that of its median worker. By contrast, Bezos’ ratio in 2015, the year Amazon got its first of multiple subsidies for warehouses in the Chicago area, sounds modest at 58 to 1. But his then his 18% stake in Amazon rose in value by more than $32 billion in 2015 (Amazon’s median worker, probably a warehouse picker, made just $28,446).

- IBM’s Louis V. Gerstner Jr. made $73.6 million in 2000, the same year the tech firm got a $660 million subsidy. That year, IBM posted profits of $8.1 billion, and it began gutting worker pensions.

- All but seven recipients were publicly traded companies, subject to shareholder pressure and a system that favors short-term returns over long-term stability and new investment.

Big Business Bias is a Long-Standing Problem

A bias toward large, already-profitable companies is nothing new. In 2015, Good Jobs First analyzed over 4,200 economic development incentive awards in 14 states. The programs we examined were theoretically open to companies of all sizes. Yet we found that 70% of the deals and 90% of the dollars went to large companies (as defined by size, ownership structure, multistate or multinational, etc.) The trend of shortchanging small business continues today.

Subsidies may not go directly to CEOs, but in boosting company profits and stock prices, they often benefit from higher salaries or stock awards. And for CEOs like Bezos and Musk, who own large portions of the companies they run, those payoffs can be massive.

Debunking the Jobs Myth

Subsidy cheerleaders often repeat the same tired and debunked talking points: bigger companies create more jobs so they should be getting bigger subsidies. Duh.

But actual research finds that subsidized companies have lower employment gains than comparable companies that do not receive subsidies. Non-subsidized companies also may end up paying the taxes the bigger companies avoid. Additionally, subsidized and “connected” corporations (defined as those that contributed to political campaigns) invest less than non-connected firms.

And of course, some big companies “grow,” but obviously at the expense of other employers. Hello Amazon. RIP Sears, Toys R Us, Bed Bath and Beyond, JC Penney, Party City, K-Mart and more than 145 other retail bankruptcies since 2015.

Whatever new jobs these companies are creating, they come at a high per-job cost: Our analysis of all megadeals in Subsidy Tracker in 2016 found taxpayers paid over $658,000 per job.

Why Race Matters

While big businesses often fail to create net new jobs, an overwhelming number of them are more likely to have committed misconduct. Large corporations throughout the U.S. economy – including 99% of Fortune 500 companies – have since the beginning of 2000 made payments to plaintiffs in at least one employment discrimination or harassment lawsuit, including ones related to race, ethnicity, and gender.

That includes Boeing, which tops the list of subsidy recipients. The company paid out nearly $80 million to settle claims of employment discrimination between 2000 and 2019. The leaders of Fortune 500 companies, like our list of top 50 recipients, are also overwhelmingly white (nearly 90% in 2019).

Even when it comes to venture capital, white men control nearly all the money – a staggering 93% of venture capital dollars. This matters because VC often funds nascent industries that can’t access traditional financing.

Regardless of the metric – home ownership, small business ownership, savings – Black people have significantly smaller shares of the pie, in large part due to systemic practices that keep them from advancing in the workplace or starting new businesses. Giving large companies public subsidies benefits a small number of white men, rather than programs that focus on truly improving economic mobility: workforce development programs, excellent public schools, small business support including affirmative entrepreneurship aid, broadband investments, and proper compensation for workers in the care economy would all be better uses of a community’s precious and limited money.

Recommendations

There is little reason to give a giant company a subsidy because they do not need them to open or expand; one study found as much as 94% of location decisions would have happened without an incentive at all. “By virtue of their size and their history, they have access to credit, they have management depth, they have established markets, they have competitive moats,” Good Jobs First Executive Director Greg LeRoy told Forbes in 2016. “At that level, there’s not much of a role for government help.”

Therefore, we recommend:

- First and foremost, disqualify large companies from getting subsidies; just exclude them in enabling legislation. Call it means testing of corporate welfare.

Short of that:

- Impose stringent, enforceable requirements for every job companies must create, including that they be directly employed and full-time, provide livable wages or industry-market wages (whichever is higher), and include benefits, paid time off and sick pay.

- Ensure the jobs created are new jobs – too often, companies relocate jobs from one site to areas (i.e. the South) where workers can be more easily exploited.

- Ensure companies offer childcare, reliable, consistent schedules and other things that make it easier for women to enter and stay in the workforce.

- Require that companies in metro areas locate new jobs on transit routes so that carless workers – disproportionately Black and Brown – can compete for the jobs.

- Provide a clear guide for when and where subsidies can be given so the target the neediest places.

Conclusion

Subsidy megadeals are the tip of a toxic iceberg, showing how exploitative, profit-driven companies take money away from vital public services to boost their bottom line. This transfer of wealth to an elite group overwhelmingly comprised of white men only exacerbates America’s racialized wealth gap that continues to grow. To create racial equity, we must save those dollars and invest them in those things that create strong, healthy, safe communities: access to health care, great schools, quality after-school programs, parks, affordable broadband, and small business development.

Methodology

Good Jobs First used its Subsidy Tracker database (specifically, the Megadeals subset) to find the 50 biggest all-time public subsidies given to companies. It used U.S. Securities and Exchange Commission filings, company websites and announcements, and media reports to get the names of people who led the company at the time the subsidy was awarded.

This research was completed in April 2023.