Good Jobs First (1998-2023): 25 Milestones

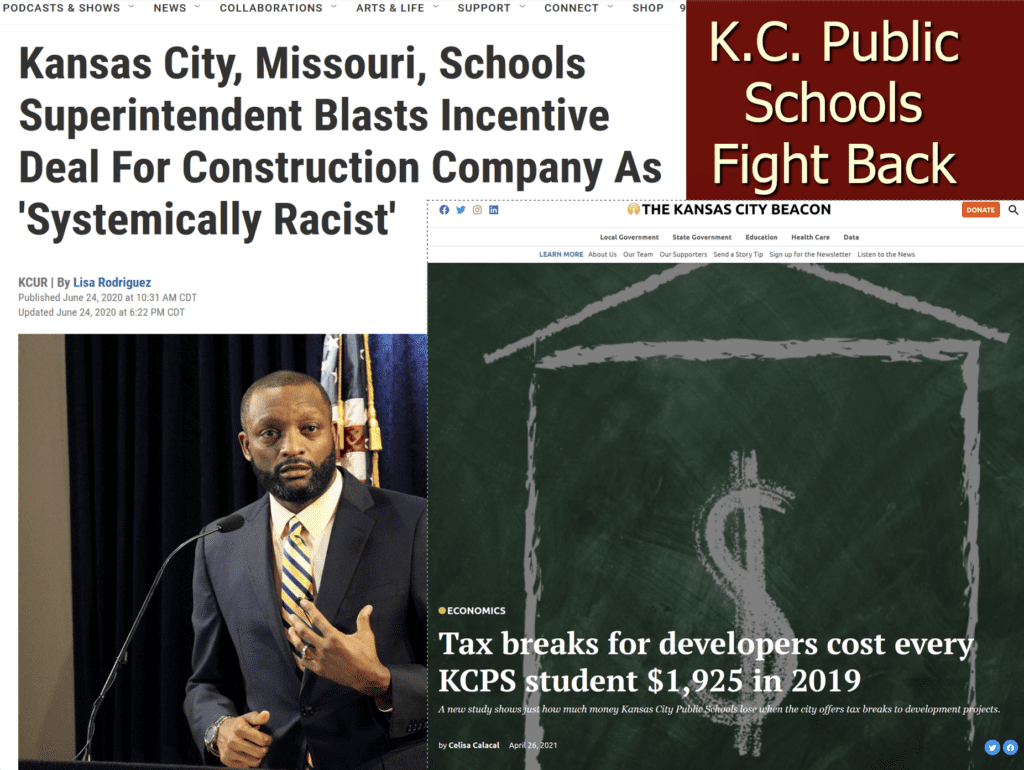

Our work, starting with getting better disclosure in states across the country, has chronicled how excessive tax breaks undermine public education, shortchange small business, and undermine the public assets that truly drive equitable development.

Good Jobs First launches on July 13, 1998

Good Jobs First launches Good Jobs New York, which during its 16-year run got New York to pass the best local disclosure laws in the United States.

For 110 leaders of the Chicago Federation of Labor, Good Jobs First creates the first labor education curriculum on how sprawl is anti-union. The following year, the national AFL-CIO passes a convention resolution denouncing sprawl, with arguments drawn from the Chicago curriculum.

Using landmark Minnesota data, Good Jobs First publishes the first U.S. study showing how economic development subsidies fuel suburban “job sprawl,” moving jobs away from communities of color and transit-rich neighborhoods

Good Jobs First publishes the first study on subsidies given to private, for-profit prisons – showing that three-fourths of such facilities have been subsidized. Findings are immediately put to use by anti-privateers fighting new private prison construction.

Good Jobs First publishes the first-ever 50-state analysis of how subsidies harm school finance.

Good Jobs First publishes “A Better Deal for Illinois,” prompting the state to enact the best disclosure law and online disclosure website in the U.S.

Good Jobs First publishes "Shopping for Subsidies How Wal-Mart Uses Taxpayer Money to Finance Its Never-Ending Growth" fueling site fights nationwide; Walmart begins reducing its subsidy demands in urban areas

Greg’s second book, The Great American Jobs Scam: Corporate Tax Dodging and the Myth of Job Creation, is published by Berrett-Koehler and widely reviewed by Business Week, New York Review of Books, Publishers Weekly, C-Span’s Book TV and many other publications.

Good Jobs First issues six “report card” studies grading states on how well, or poorly, they disclose company-specific subsidies. Governors and commerce secretaries in at least 35 states publicly respond, and some ask us for help “to get a better grade next time”

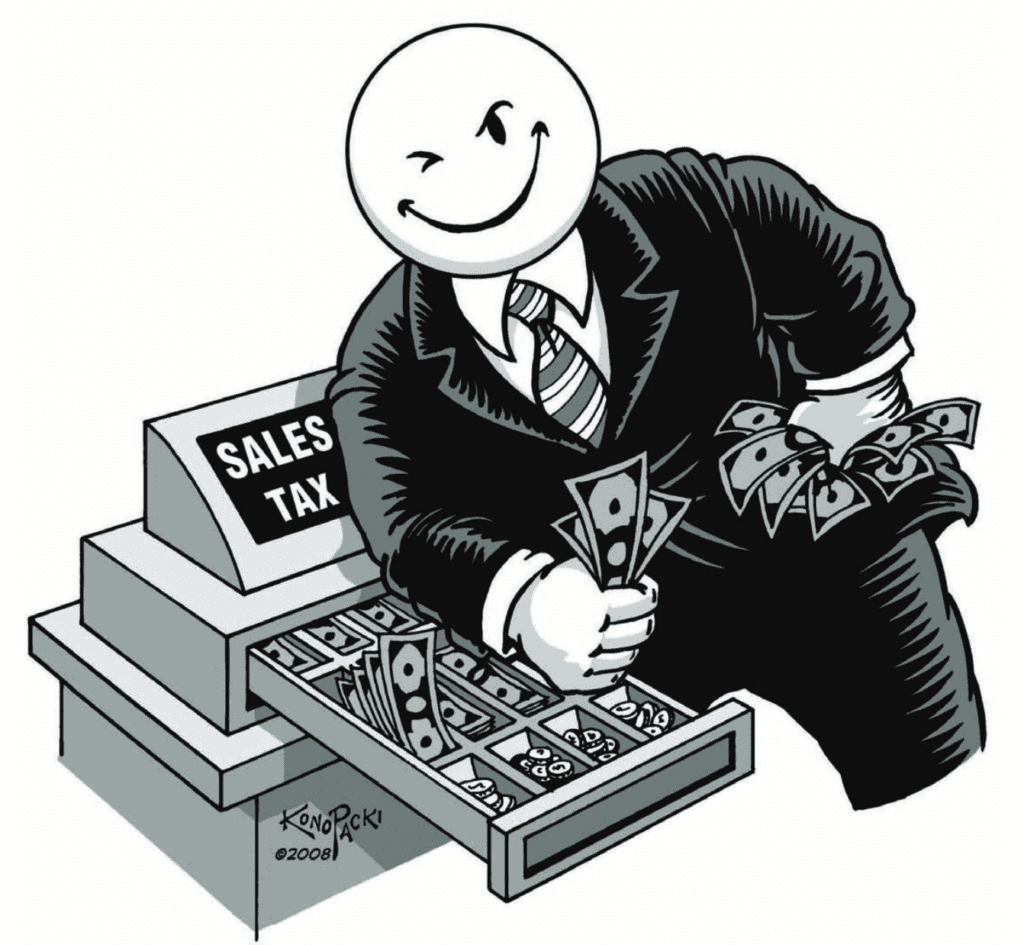

Good Jobs First publishes the first national exposé revealing that retailers in 25 states are legally “skimming” more than $1 billion annually in consumer-paid sales taxes. Colorado and Virginia soon enact reforms.

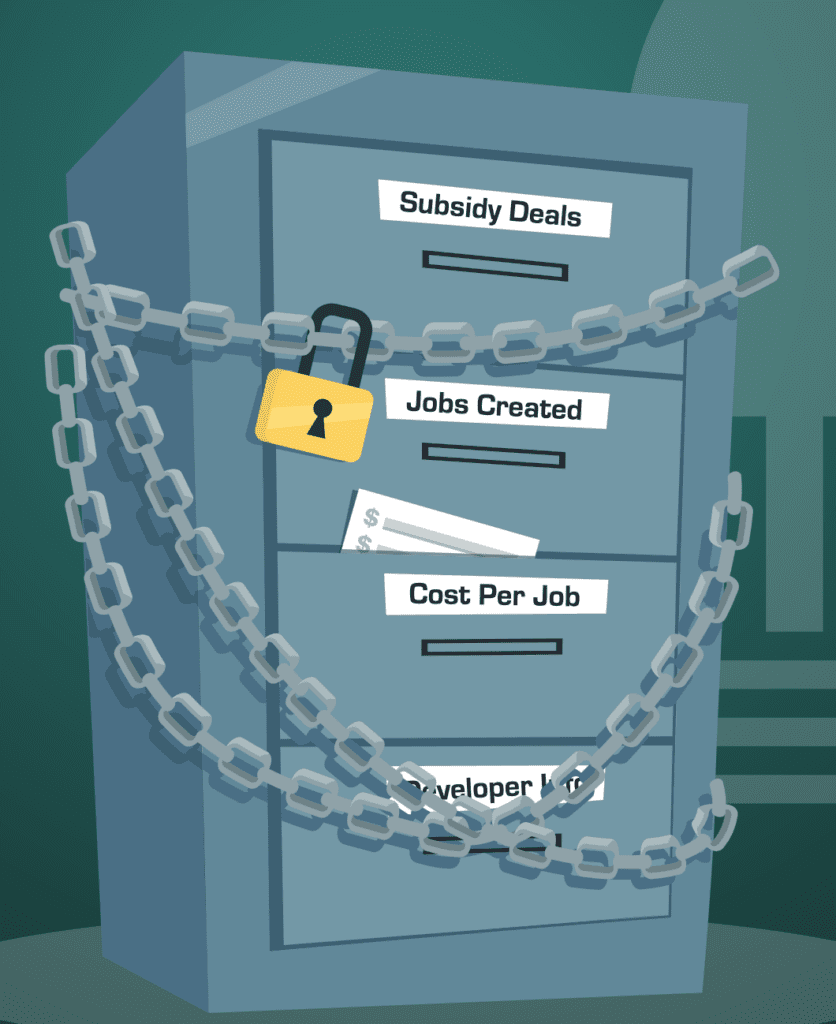

Good Jobs First launched Subsidy Tracker, the most comprensive public database of which companies receive economic development subsidies.

Good Jobs First publishes Paying Taxes to the Boss, the first exposé on how some states allow companies to pocket their employees’ state personal income taxes – without the workers’ knowledge or consent.

GJF issues the first-ever “report card” studies on big-city and big-county subsidy transparency. The cities that score best are those where grassroots groups, often assisted by Good Jobs First, have agitated: Memphis, New York, Chicago and Austin.

Good Jobs First begins assisting Together Louisiana against the nation’s most corrupt property tax abatement program. By 2022, TLA’s campaign was saving almost $300 million annually for schools, public health, public safety and infrastructure.

Good Jobs First launches Violation Tracker, the first wide-ranging database on corporate crime and misconduct. It becomes a global juggernaut.

Stung by big layoffs by Boeing in Puget Sound despite two multi-billion-dollar megadeals, the State of Washington calls Good Jobs First to testify. We prove that in four other states, the company was bound to statewide employment levels. The State enacts robust disclosure on job creation for all new incentive programs going forward.

Good Jobs First mounts a successful national comment campaign to win the first-ever government accounting rule requiring most local governments to disclose how much revenue they lose to economic development tax breaks – “GASB Statement No. 77”

Good Jobs First assists elected leaders in Philadelphia, helping rein in lavish property tax abatements that had been given to nearly all residential construction and rehab.

Good Jobs First exposes Amazon’s strategy of aggressive subsidy-seeking for its warehouses when its Prime business model flips to rapid delivery. By 2023, we document more than $6.1 billion in subsidies to the retail giant.

Good Jobs First releases Grand Theft Paycheck, exposes how widespread wage theft occurs among large corporations.

Good Jobs First's Big Business Bias report reveals how virtually every large company had paid damages or reached an out-of-court settlement in a discrimination or harassment lawsuit.

Good Jobs First launches Covid Stimulus Watch to track CARES Act spending. We break the story of how charter schools received far more support than public schools, and enabled journalists to show how health care chains that had repeatedly defrauded Medicare or Medicaid got huge funding.

Good Jobs First launches Violation Tracker UK, modeled after the U.S. version.

Our study proving that school districts across New York State lose $1.8 billion per year prompts legislation to take the school share of property taxes off the table in all future abatement deals.