Under a provision of the Inflation Reduction Act, some factories making batteries for electric vehicles will each receive more than a billion dollars per year from the U.S. government, with no requirement to pay good wages to production workers. Thanks to the Advanced Manufacturing Production Credit, also called 45X for its section in the Internal Revenue Code, battery companies will receive tax credits that they can use, sell, or cash out.

The 45X program alone will cost taxpayers over $200 billion in the next decade, far more than the $31 billion estimated by Congress’s Joint Committee on Taxation. On top of 45X and other federal incentives, factories manufacturing electric vehicles and batteries have also been promised well over $13 billion in state and local economic development incentives in just the past 18 months.

EXECUTIVE SUMMARY

Under a provision of the Inflation Reduction Act, some factories making batteries for electric vehicles will each receive more than a billion dollars per year from the U.S. government, with no requirement to pay good wages to production workers. Thanks to the Advanced Manufacturing Production Credit, also called 45X for its section in the Internal Revenue Code, battery companies will receive tax credits that they can use, sell, or cash out.

The 45X program alone will cost taxpayers over $200 billion in the next decade, far more than the $31 billion estimated by Congress’s Joint Committee on Taxation, according to a Good Jobs First analysis. On top of 45X and other federal incentives, factories manufacturing electric vehicles and batteries have also been promised $13 billion in state and local economic development incentives in just the past 18 months.

What do local communities get from companies in exchange for public money? The Biden administration says the IRA will create “good-paying union jobs,” but the federal tax credit has no job quality requirements for permanent jobs and doesn’t mandate companies pay market-based wages or benefits.

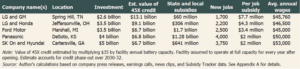

Good Jobs First did the math for five recently announced battery factories. Here’s what we learned:

- Total subsidies will range from $2 million to $7 million per job.

- Average annual wages, as announced, will be below the current national average for production workers in the automotive sector.

- The 45X credit alone is large enough to cover each facility’s initial capital investment cost and wage bill for the first several years of production.

For example, Ford Motor’s new $3.5 billion battery plant in Marshall, Michigan, will be eligible for an estimated $6.7 billion in federal 45X tax credits. State and local governments have already awarded it an additional $1.7 billion in subsidies. The company has promised to create 2,500 new jobs that it says will pay an average annual wage of just $45,000 a year, while reaping subsidies of $3.4 million per job.

As plans for these facilities are finalized, we recommend a set of policy actions to set the country’s emerging EV-battery industrial complex on the path to “high road” employment:

- Executive agencies should adopt the S. Employment Plan (USEP) when federal agencies purchase electric vehicles. USEP is a framework for soliciting and evaluating public contract bids through the lens of hiring equity and job quality.

- The federal government should require companies seeking federal subsidies and contracts to disclose past labor and occupational health and safety violations and certify regulatory compliance among subcontractors and suppliers.

- State and local governments should require subsidy recipients to pay wages equal to or greater than market-level wages and enforce “clawback” provisions if companies fail to deliver promised jobs or investment.

- Workers and communities should demand Community Benefits Agreements (CBAs) with battery makers. Negotiated when local governments make plans to aid new or expanding companies, these CBAs should include firm commitments on job quality and wages, local hiring, state of the art workplace safety, and toxic emissions monitoring.

KEY FINDINGS

Millions in Subsidies per Job at Battery Plants Paying Low Wages

Five recently announced EV battery plants, all to begin production in the next two to three years, well illustrate the astounding scale of public money set to flow to battery makers in the next decade.

The IRA’s Advanced Manufacturing Production Credit, the “45X credit,” is expected to pay the seven companies building these plants over $1 billion per year per facility in federal corporate income tax credits, amounting to several billions of dollars for each facility by the time the credit is phased out in 2033.

On top of that, states and local governments have larded on millions, in some cases billions, more in subsidies. These megadeals take a variety of forms, often including multiple tax breaks, grants, and public spending on site readiness and infrastructure improvements.

Adding together federal, state, and local support yields subsidies ranging from $2 million to $7 million per job. And those are undercounts given that some forms of state and local support remain undisclosed and more federal money is inbound.

Meanwhile, early indications are that all five plants will be offering sub-market wages for production workers.

The nationwide average hourly wage for production workers in the U.S. automotive sector is $28.41 an hour, or $59,093 a year for a full-time worker. That’s more than expected average wages at any of these facilities, which are already biased upward by the inclusion of higher-paid supervisory and managerial workers in the facility’s employment total.

Production workers at General Motors and LG’s new joint venture battery plant in Warren, Ohio are expected to make a paltry $16.50 an hour to start, up to $20 an hour after seven years.

At such low wages, the 45X credit on its own is enough to completely cover these companies’ capital investment costs and their total wage bill for the first several years of production, while still leaving them with money left over to pay for other operating costs (or stock buybacks).