New government data reveals that, compared to eight neighboring school districts, Cincinnati Public School (CPS) students are disproportionately harmed by tax abatements. Compared to other major Hamilton County school districts, on an absolute and per-student basis, Cincinnati school children have lost significantly more revenue to tax breaks given in the name of economic development.

Specifically: CPS lost $80.9 million in the past six fiscal years to tax abatements, or $2,394 per student.

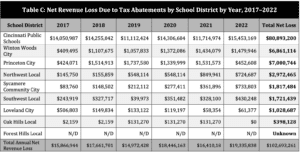

Among the nine school districts, there is a clear pattern of discrimination by race and income. The three school districts that are majority-students of color (Cincinnati, Winton Woods, and Princeton City) all lose three to 23 times more per student than the six majority-White districts. Those same three school districts also are the poorest: most of their students are eligible for Free or Reduced Priced Meals.

KEY FINDINGS

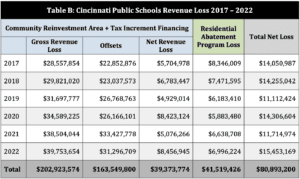

Between 2017 and 2022, Cincinnati Public Schools (CPS) lost at least $244.4 million in gross revenue due to tax abatements (including Community Reinvestment Area, Tax Increment Financing, and Residential Abatement losses). During the same six years, the school district also received a total of $163.5 million in offsetting reimbursements, for a net revenue loss of $80.9 million.

Understanding the true impact of tax abatements for CPS is made needlessly difficult by the district’s chronic inaccuracies in its ACFRs. In 2017, CPS erroneously stated in its ACFR that the City of Deer Park abated $18.4 million when that abatement was in fact by the City of Cincinnati. The district also incorrectly reported the amount of offsetting revenue it received. CPS’s 2017 ACFR notes that it did not receive any revenue to offset the cost of abatements. In fact, it received $22.9 million.

In total, the district told GJF that it received $163.5 million in CRA and TIF reimbursements between fiscal years 2017 and 2021; this revenue is not accounted for in the ACFRs.

In addition, the disclosure wording in the district’s ACFRs is inconsistent and ambiguous, sometimes referring to “revenue reduced by CRA agreements” and other times noting “the total revenue related to CRAs.”

The inaccuracies of CPS’s reporting were first documented five years ago, in a report by Policy Matters Ohio report entitled “Tax abatements cost Ohio schools at least $125 million.”

In absolute dollars, Cincinnati Public Schools’ losses to abatements dwarfed those of Hamilton County’s next eight biggest school districts — combined. CPS lost $80.9 million (net) while the eight suburban districts reported losses of $21.8 million. This despite the fact that the combined student enrollment of the eight suburban districts is about 30% greater than Cincinnati’s.