This is the second blog in a two-part series investigating state and local transparency of tax increment financing programs. Read part one of this series, “Tax Increment Financing Disclosure: A Step in the Right Direction.”

We have advocated over the years for better state disclosure of subsidy awards, and made some progress. However, reporting of locally controlled programs (those enabled by state legislatures but managed by municipal governments) continues to be inconsistent and incomplete.

That includes tax increment financing (TIF), a geographically targeted tool originally designed to bring economic activity to distressed neighborhoods. Today, many states have significantly loosened the rules around when a TIF can be created, allowing city and county governments to use them with little oversight or justification.

When dealing with costly, controversial programs such as TIF, consistency in reporting is as important as the data itself. In addition to resources like Tax Break Tracker, a Good Jobs First database that collects revenue governments forgo through various economic development programs, state-level databases aggregate local TIF activity to help us determine which communities lose the most over time and how those communities compare with others of similar size and characteristics.

Thanks to the efforts of watchdog organizations, some states have started centralizing TIF data online. These databases enable public participation by providing increased access to information. We rated all of the active state databases available (we wish there were more), based on their overall helpfulness to the general public:

A Survey of the Five State-level Tax Increment Financing Transparency Databases

| Illinois | Iowa | Michigan | Missouri | Ohio | Texas | |

| Is the data disclosed annually? | Y | Y | Y | Y | N | Y |

| Can you download the data? | Y | Y | Y | N | Y | Y |

| Is the name of the developer being reimbursed disclosed? | N | N | Y | Y | Y | N |

| Is the actual subsidy amount disclosed? | Y | Y | Y | Y | N | Y |

| Does the database disclose project details (i.e., jobs created, project address, investment, duration) | Y | Y | Y | Y | Y | N |

| Overall Helpfulness | 4/5 | 4/5 | 5/5 | 4/5 | 3/5 | 3/5 |

Sources: Illinois State Comptroller, Tax Increment Financial Reports; Iowa Department of Management & Legislative Services Agency, Local Government TIF Expenditures By Project & Debt; Michigan Economic Development Corporation, Brownfield TIF Project Map; The Office of Missouri State Auditor, Tax Increment Financing Reports; Ohio Department of Development, Community Reinvestment Area Program Company Tax Incentives; Texas Comptroller, Chapter 311 Tax Increment Reinvestment Zone Annual Reports.

The best kind of state-level TIF databases enable a more comprehensive understanding of the program’s impact on local revenues.

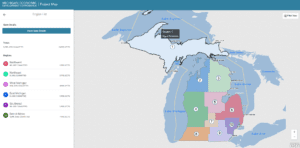

The Brownfield TIF data on the Michigan Economic Development Corporation’s incentive database demonstrates that transparency is not only possible, but can be stylized in such a way that is easy to navigate for the average member of the public.

The MEDC database contains a mapping function which can be filtered by region and county. It also discloses the name of the developer operating in the TIF zone, along with the address, and project details such as investment and jobs numbers. It can also be downloaded as a summary report. All of these features should be standard practice for disclosure websites.

To be able to evaluate TIF, a community must know where the districts are located, what companies benefit, the cost of the subsidies, and how much of their money is diverted from vital public services.

Leaders eagerly signing their constituents up for 20 years of tax redirection (or more), ought to be monitoring the progress of these programs. State and local governments are responsible for ensuring TIF is being used responsibly – and that means tracking outcomes and making that data available.

Review our data sources on Subsidy Tracker for more information on these TIF databases.

Learn more about how TIF works on our TIF Project Page.