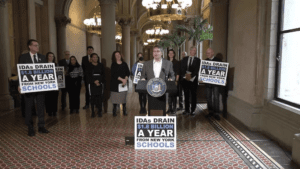

Diverse leaders in Albany denounce corporate tax breaks that take $1.8 billion annually from schools

A wide-ranging coalition of education, labor and non-profit groups, and elected leaders gathered yesterday in Albany to support legislation that would protect New York State schools from tax abatements totaling $1.8 billion per year.

In addition to New York State United Teachers and the NYS AFL-CIO, the legislation is backed by the NYS School Board Association, NYS Council of School Superintendents, the NYS Parent Teacher Association — and many others (full list below).

The bills, introduced by Senator Sean Ryan and Assemblymember Harry Bronson, are simple: “…prohibits a town, city, or county industrial development agency from waiving taxes which would be received by a school district.”

- Read Riverhead Local’s story: Riverhead teachers union speaks out at Albany rally for bills to ban IDA school tax exemptions

- Read Politico’s story: The $1.8 billion that schools don’t get

The bill was introduced in response to a Good Jobs First report released last year.

The groups gathered “are fed up with this notion that we continue to give away school revenue in the name of economic development. Report after report has clearly shown these programs are not working. We are not getting the desired outcomes, we are not getting the number of jobs promised, these business are closing up shop and going away,” said Ron Deutsch, of New Yorkers for Fiscal Fairness. “This is flawed public policy and it needs to end.”

Said Ryan: “New York State’s best economic development program is their highly educated people.”

“While we’re busy making these massive investments in public education, there’s a hidden problem exacerbating school budget gaps – year after year, [Industrial development Agencies] across the state give corporate handouts that cost New York State school districts millions and millions of dollars,” he said, and local taxpayers are being asked to make up the difference.

Melinda Person, president of New York State United Teachers, said corporate tax breaks cost every Albany student $925 per year. That money belongs with schools, she said.

“We do support economic development, economic development that works like investing in SUNY [State University of New York] and CUNY [City University of New York] and CTE [career technical education] programs to develop the workforce of the future,” she said. “What we don’t support are tax breaks that drain resources from our schools.”

Watch the full press conference.

Read the full letter (also below).

Learn more about Statement No. 77 on Tax Abatements, the accounting rule which made our analysis possible.

January 31, 2024

Andrea Stewart-Cousins, Majority Leader, New York State Senate

Carl E. Heastie, Speaker, New York State Assembly

Re: Support for S89/A351 – Prevents IDAs from abating tax revenue that would otherwise go to schools

Dear Majority Leader Stewart-Cousins and Speaker Heastie,

We write to express our strong support for a bill introduced in both houses, S89 (Ryan) / A351 (Bronson), which prohibits Industrial Development Authorities from abating property taxes that would otherwise fund public schools.

Shockingly, New York’s schools lose $1.8 billion a year of potential revenue from IDA tax abatements. Compounding the harm, the diversion of school funding by local IDAs has been shown to have a clearly disproportionate impact on students of color.

An in-depth analysis of New York’s local tax data by national watchdog group Good Jobs First shows specifically where and how the state’s IDAs diverted at least $1.8 billion in potential revenue from public schools in FY 2021 alone. Their research also clearly shows that New York’s IDA tax abatements take away more education funding from students of color than other students.

According to the FY 2021 data compiled by Good Jobs First, in that one year, New York’s IDA tax abatements cost an average of $541 per pupil. However, the data shows a very wide range of impacts on school funding. For example, West Genesee schools, which are 85% white, lost $3 per student that year, but over in Peekskill, where 90% of students are of color and three fourths qualify for free lunches, the IDA diverted $5,000 per pupil.

Similarly, the IDA diverted $5 per student per year in Hoosick Falls, which is almost all-white, compared to $2,000 per student for Uniondale, whose schools overwhelmingly serve students of color.

We believe unelected IDAs should not be able to abate potential sources of school funding when schools are already having a difficult time meeting the needs of students in this post-COVID era and the state is assuming big budget deficits.

New York is better than this. States like Florida, Alabama and Louisiana have already passed laws that prevent unelected local development agencies from abating tax revenue that would otherwise fund public schools. The best investment of New York’s public tax dollars is in public education, not corporate giveaways, which is why we support S89 (Ryan) / A351 (Bronson).

Sincerely,

- New York State United Teachers (NYSUT)

- NYS AFL-CIO

- Civil Service Employee Association (CSEA)

- American Federation of State, County, Municipal Employees (AFSCME)

- NYS Council of School Superintendents (NYSCOSS)

- NYS Parent Teacher Association (NYSPTA)

- NYS School Board Association (NYSSBA)

- Riverhead School District School Board

- Alliance for Quality Education

- Diane Ravitch

- The Network for Public Education

- Reinvent Albany

- Citizen Action of New York

- American Economic Liberties Project

- Fiscal Policy Institute

- Good Jobs First

- New York State Council of Churches

- New Yorkers for Fiscal Fairness

- NYS Labor-Religion Coalition

- Strong Economy for All Coalition