Schools in New York State lost at least $1.8 billion in fiscal year 2021 to corporate tax abatements. That makes New York schools by far the biggest known losers to abatements, more than three times second-place South Carolina.

This study’s findings were enabled by a new government accounting rule that requires — for the first time ever — that most school districts, cities and counties disclose how much revenue they lose to such corporate tax breaks. The new reporting rule is Governmental Accounting Standards Board (GASB) Statement 77 on Tax Abatement Disclosures.

We argue in this white paper that, even if cost and benefit reporting periods do exactly not align, localities should always report the latest cost data available. Disinvesting the state’s foundational workforce development system for corporate subsidies makes no sense at a time of skilled labor shortages and very low unemployment. In addition to our fresh evidence here, there is decades of evidence that industrial development agencies (IDAs) are failing to deliver a better upstate economy. We recommend eliminating IDAs for their lack of accountability. Short of that, we recommend prohibiting IDAs from entering into agreements that abate school tax revenues.

The alternative is the status quo: ever–higher property tax rates on New York residents to mask the large and rising costs of corporate tax abatements.

Key Findings

At Least 318 Affected Districts (plus the Big Five): New York has 685 local public school districts, excluding New York City. At the time of this writing, 650 of them have issued their FY 2021 audited financial statements, and of those, 416 have the required Notes on tax abatement disclosures (see Appendix C on GASB Statement No. 77). Excluding nine that did not provide any dollar figures, 21 that provided only the amount of payment-in-lieu-of-taxes (PILOTs, or offsetting benefits, but not the corresponding abatement costs), and 68 that reported $0 net foregone revenue, we have 318 school districts that reported losing revenues, serving 900,025 students (see Appendix A).

At Least 318 Affected Districts (plus the Big Five): New York has 685 local public school districts, excluding New York City. At the time of this writing, 650 of them have issued their FY 2021 audited financial statements, and of those, 416 have the required Notes on tax abatement disclosures (see Appendix C on GASB Statement No. 77). Excluding nine that did not provide any dollar figures, 21 that provided only the amount of payment-in-lieu-of-taxes (PILOTs, or offsetting benefits, but not the corresponding abatement costs), and 68 that reported $0 net foregone revenue, we have 318 school districts that reported losing revenues, serving 900,025 students (see Appendix A).

Revenue Losses Are Increasing: Collectively, these 318 school districts reported $429.8 million in total net foregone revenue (the difference between $700.7 million in self-reported gross tax reductions and the $270.9 million total offsets from self-reported PILOTs). That is $18 million higher than the 2017 and 2019 totals. For most of these districts, all or part of the revenue reductions were caused by the actions of their county or municipal Industrial Development Agencies (IDAs).

Big Five Districts Have No Data: School districts in the five largest cities (hereafter referred to as the “Big Five”)—New York, Buffalo, Rochester, Syracuse, and Yonkers—are not among the self-reporting 318 because their portions of the foregone revenue are not disclosed separately by their parent governments. This means we must apportion and estimate how much the schools lost.

Especially Severe Losses and Trends: Six school districts reported net tax abatements greater than $10 million. They are the Farmingdale, Hauppauge, Oswego, Peekskill, Rensselaer, and Uniondale districts. Oswego City School District reported the highest amount, $28.6 million, though from its disclosure wording, whether this amount is the gross or the net tax reduction is unclear—a major problem that will be detailed later.

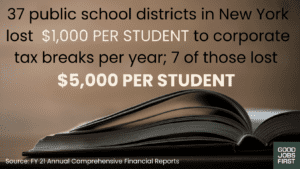

Seven school districts reported per-pupil, per-year net losses of more than $5,000. (See Appendix B.) Oswego, Peekskill, and Rensselaer again find themselves in this top-losing list, in addition to Chateaugay, Northern Adirondack, Sharon Springs, and Valley Stream No. 30 districts. Fifteen more lost between $2,001 and $5,000 per student per year. And another 15 lost between $1,000 and $2,000. All told, 37 New York State school districts lost more than $1,000 per student per year.

Seven school districts reported per-pupil, per-year net losses of more than $5,000. (See Appendix B.) Oswego, Peekskill, and Rensselaer again find themselves in this top-losing list, in addition to Chateaugay, Northern Adirondack, Sharon Springs, and Valley Stream No. 30 districts. Fifteen more lost between $2,001 and $5,000 per student per year. And another 15 lost between $1,000 and $2,000. All told, 37 New York State school districts lost more than $1,000 per student per year.

More Unreported Abatement Losses: Implausibly, 21 districts beyond the 318 claim, in their audited annual financial reports, that the amount of taxes abated was not available for inclusion in their financial reports, even though these same districts reported offsetting payments collected in lieu of taxes. (That is: they reported $30.7 million in benefits, but did not disclose the costs those offsets are intended to defray.) As PILOTs typically offset about half of abatement costs, the revenue losses for these districts could add another $61.4 million or more in gross losses to the state total.

Read the full report.