December 23, 2021 — Good Jobs First today revealed that Amazon.com, Inc. has located at least 171 of its newest or soon-to-open warehouses in Opportunity Zones (OZs), where they may create huge capital gains tax breaks for Amazon and/or other investors. It is part of a massive pandemic-fueled expansion by the online giant, which grew from 473 sites from the end of 2019 to 1,237 by December 2021.

Another 93 warehouses have been approved to open in 2022 and 2023.

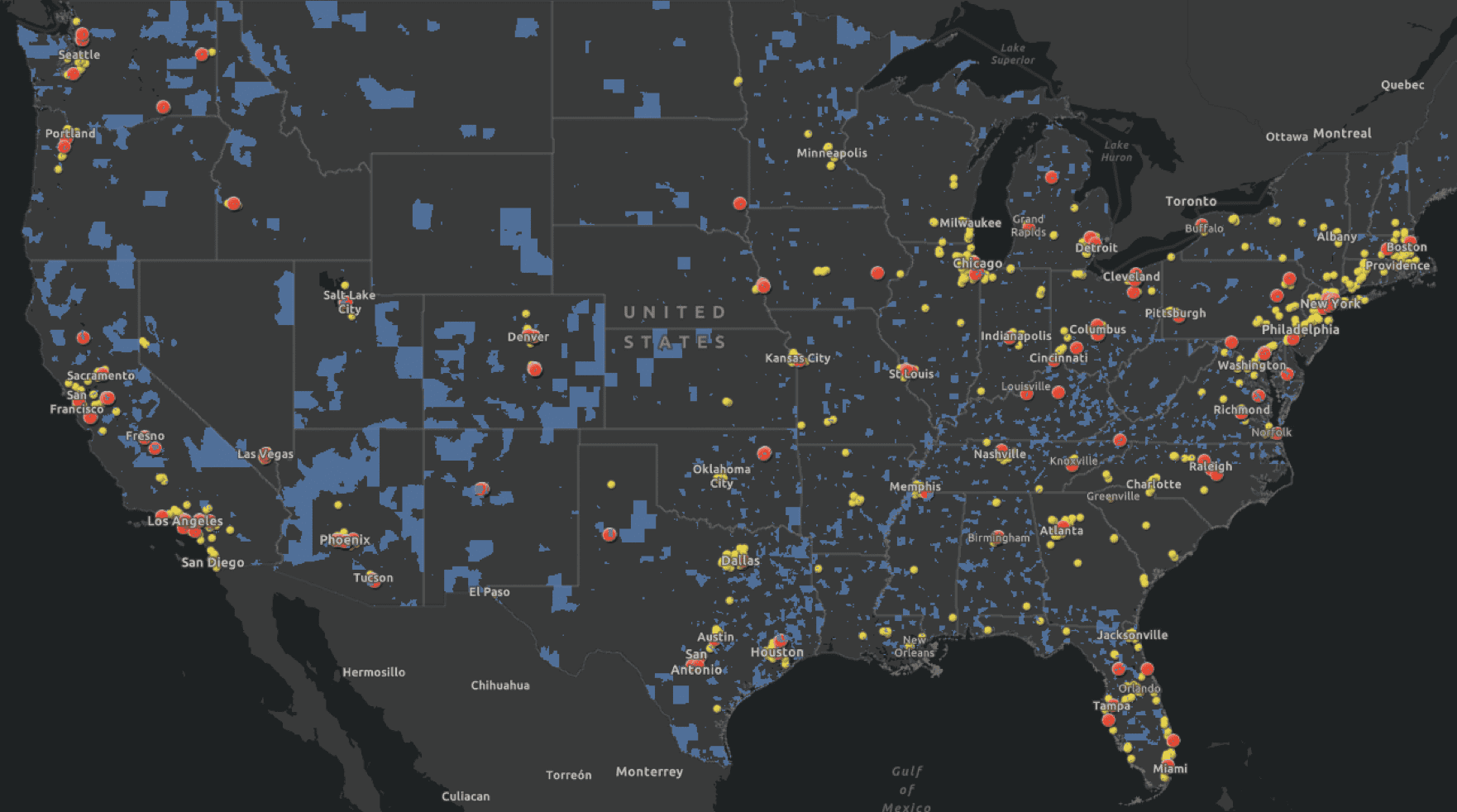

All of the new warehouses are visible in Good Jobs First’s updated interactive storymap, “Mapping Amazon.” Users can explore the location and type of Amazon facilities, their proximity to highways, airports, affluent neighborhoods (with the most Prime households) – and now also Opportunity Zones.

- Our time-lapse video shows Amazon’s explosive pandemic-era growth

An unknown share of the 171 active and soon-to-open warehouses in Opportunity Zones stand to benefit from the lavish tax breaks enacted as part of the federal program, quietly and without a single public hearing, under the 2017 Trump tax-cut bill.

“With its insatiable appetite for public subsidies, Amazon is disinvesting communities for short-term profits,” said Greg LeRoy, executive director of Good Jobs First, which first revealed the existence of Amazon’s subsidy-grabbing department in a study published five years ago. “Our Amazon Tracker already shows $4.2 billion in U.S. subsidies, including more than $669 million this year alone. But because Opportunity Zone investors are mostly secret and undisclosed, we cannot estimate the direct or indirect subsidies to Amazon created via OZs.”

“Given the former President’s animus for Amazon’s founder Jeff Bezos, I wonder how Trump would feel about creating a new subsidy for the company,” LeRoy added.

Although much media coverage of OZs has focused on wealthy individuals using them, Good Jobs First reminds readers that corporations also have capital gains that can be sheltered by OZs; those gains totaled about $2.3 trillion when OZs were enacted.

“Amazon locates near major transportation routes and close to its Prime customers, which it must do for rapid delivery. Still, it demands outrageous public subsidies everywhere it goes,” said Good Jobs First’s Senior Economic Development Research Associate Christine Wen, who mapped the data. “As we said in April 2020 when we first launched ‘Mapping Amazon,’ there is no need to subsidize Amazon to do what its business plan requires. Now it appears that Opportunity Zones, by virtue of their urban locations, are creating yet another form of subsidy windfall for Amazon.”

Opportunity Zones, created as part of Trump’s 2017 Tax Cuts and Jobs Act, allow wealthy individuals and corporations to reinvest capital gains into a wide range of real estate and business projects, including warehouses. By reinvesting the gains and leaving them in the Zones for certain periods, investors get tax-rate cuts and payment deferrals. Any new gains made on the OZ investments can become completely capital gains tax-free.

- Check out Good Jobs First’s FAQ on Opportunity Zones

The Good Jobs First storymap shows that Amazon usually locates within a 20-minute drive of affluent areas with the most Prime members, but usually even closer to low-income neighborhoods that receive the brunt of traffic and pollution.

Good Jobs First offers three immediate recommendations:

- Stop giving Amazon (and all other retailers) public subsidies unless the project is to bring basic amenities to, for example, a food desert.

- Require Amazon (or any other warehouser) to enter into a legally binding Community Benefits Agreement in every town it locates, to hire locally, pay living wages, fund traffic improvements, mitigate harmful environmental impacts, and pay full, unabated taxes to support schools, law enforcement and other public services from which it freely benefits.

- Cap economic development subsidies given to all companies at no more than $35,000 per job, and the job must be permanent, full-time, directly employed by the subsidized company, pay a living wage, and provide health benefits.

“As one of the most valuable companies in the world, Amazon should not get a dollar more in subsidies,” Wen said.

Communities housing Amazon warehouses need tax revenues to handle day-to-day public services, as well as emergencies like tornadoes. In Edwardsville, Illinois, where six Amazon warehouse workers were killed by a recent twister, the company leases two warehouses from developers that won’t be paying any property taxes for 10 years, thanks to 100% property tax abatements two companies received.

Illinois residents have given Amazon at least $742,413,199 in subsidies, according to our Amazon Tracker.

Good Jobs First, founded in 1998 and based in Washington, DC, is a non-profit, non-partisan resource center promoting government and corporate accountability. It runs Amazon Tracker, a popular database that compiles taxpayer-funded subsidies the company receives.