Spending reports worded so oddly we had to call for decoding. Tens of millions of dollars in unreported revenue losses that disproportionately harm Black and Brown students. Public officials touting benefits while failing to record the costs of tax breaks.

It’s another week in the data-sleuthing life of Good Jobs First.

Our newest study, Corporate Tax Abatements and Cincinnati-Area Public School Revenues, reveals that compared to eight neighboring districts, Cincinnati Public School (CPS) students are disproportionately harmed by economic development tax breaks.

Between 2017 and 2022 CPS students lost at least $80.9 million due to tax abatements – that’s $2,394 per student.

It took us almost three months to piece those numbers together. It should have taken us three hours. So you can imagine our shock to meet a whole lot of frustrated parents, teachers, residents, and even a state representative who said they feel like they’ve been gaslit for many years by chronically inaccurate and misleading financial reporting by CPS.

Why three months? Because we analyzed the backward-looking annual financial reports (called Annual Comprehensive Financial Reports, or ACFRs) of CPS and the eight next-biggest school districts in Hamilton County between 2017 and 2022.

It should have been easy. According to Ohio law, all school districts are required to follow a set of accounting rules called GAAP (Generally Accepted Accounting Principles) that govern the content of ACFRs, including how much revenue districts lose to tax breaks given in the name of economic development.

But Cincinnati Public Schools is failing to disclose this information properly. Its reporting failures include:

- attributing an $18.4 million revenue loss to the City of Deer Park (when it was really Cincinnati);

- incorrectly reporting the amount of abatement-offsetting revenue it received;

- claiming it did not receive any offsetting revenue when it did (to the tune of $22.9 million);

- and completely failing to report revenue lost to the single costliest abatement programs— the city’s controversial residential tax abatement program.

Cincinnati is unusual for its heavy use of residential tax breaks, which have disproportionately benefitted white and higher-income neighborhoods, according to a city-commissioned report. The program gives years-long property tax breaks to homeowners who build new or rehabilitate existing homes. These giveaways cost CPS at least $41.5 million since 2017 — more than CPS’s other two tax abatement programs combined.

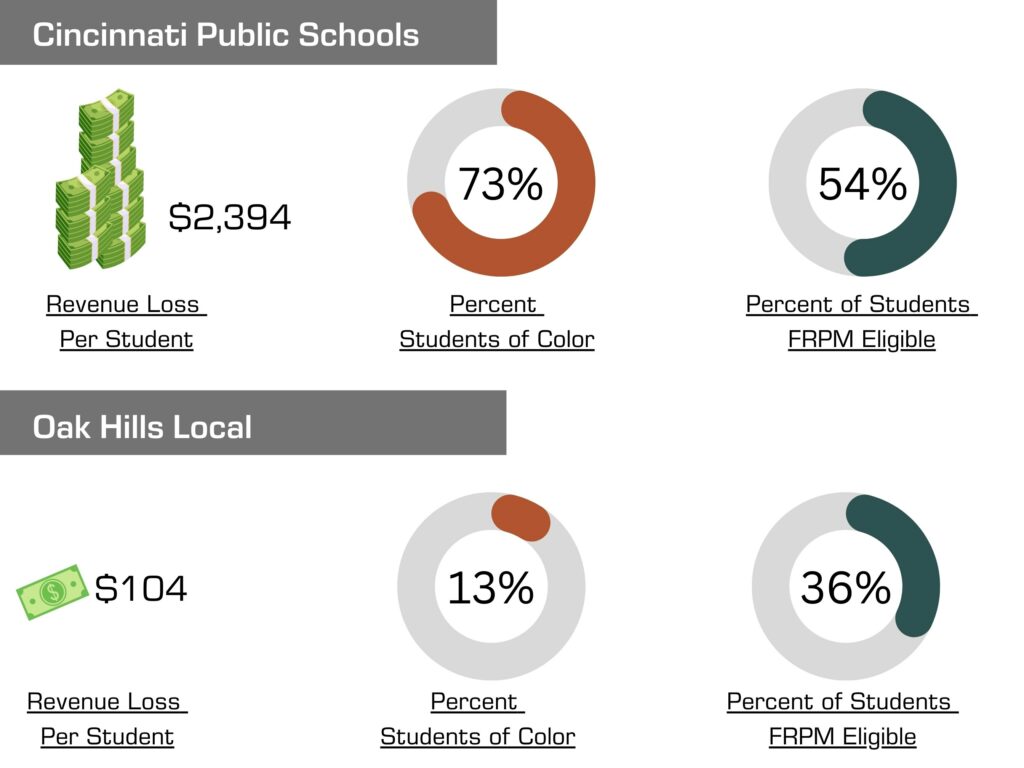

After several weeks of back-and-forth communications with CPS staff and others, we finally determined actual revenues lost to tax abatements between 2017 and 2022. And the data revealed an alarming trend — districts with the greatest share of students of color lose by far the greatest amount of revenue per student to tax abatements. These districts also have the greatest share of students eligible for Free or Reduced Price Meals, meaning they come from low-income households.

During this six-year period, students at CPS lost 23 times more revenue ($2,394) than their neighbors just miles away at Oak Hills Local School District ($104). Students at Winton Woods City Schools and the Princeton City School District also lost significantly more than other districts. The top three biggest losers, Cincinnati, Winton, and Princeton, all lost over $1,000 per student and have majority-minority student bodies, whereas the next biggest loser (Southwest) lost less than $400 per student, with students of color making up a mere 6% of its population.

These numbers are alarming, it’s no wonder they were hidden from the public.

Financial reporting inaccuracies are not just a headache for budget watchdogs, they make it virtually impossible to determine what tax abatements truly cost residents. Without that figure, a community can’t meaningfully decide whether these giveaways are the best use of their money.

For instance, rather than subsidizing home improvement projects, they may prefer to improve their children’s school facilities, which CPS described as “deteriorated and obsolete”. They may prefer smaller class sizes, or more after-school offerings.

Last month CPS unveiled its $565 million budget proposal for the upcoming 2023-24 school year, which included a $48 million cut from the current year.

As parents, teachers, and district staff fight over the right path forward in the coming months, one thing is clear: everyone should be able to come to the table with a full and accurate picture of the district’s finances.

Cincinnati’s school board and superintendent also have an opportunity to step up and become champions for their students’ fair funding. We pointed them to the Kansas City Public Schools board as a worthy model. Abatement-disclosure data revealed the same discriminatory pattern there, and the board and superintendent are acting on it.