Cancer Alley residents see millions returned annually

Note: This is the second in a new series of quarterly reports produced by Good Jobs First that look at the relationship between race, ethnicity, and economic development.

Louisiana’s Black and Brown students are benefiting greatly from a fragile set of reforms to the nation’s most notorious property tax abatement program. But the state’s next governor, who will take office in January, could reverse them.

The backstory:

For decades, Louisiana’s low-income communities of color that were systematically poisoned by the petrochemical industry also watched their tax bases depleted by handouts to those very corporations, through a program called the Industrial Tax Exemption Program (ITEP).

Until recently, ITEP gave an automatic 10-year rubber stamp to tax breaks for every new, expanded, or refurbished refinery, chemical plant, or power plant in the state. It impoverished school districts, sheriffs’ juries, hospitals, fire departments, and libraries.

By 2018, ITEP was costing public services $1.2 billion per year.

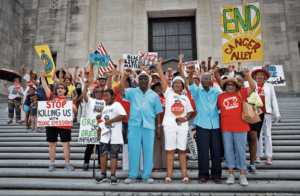

Pollution and tax-break harms fell hardest on the mostly Black and Brown residents of “Cancer Alley,” the 14 parishes along the Mississippi River between Baton Rouge and New Orleans that generate a quarter of the country’s petrochemical production.

Thanks to executive order reforms made by Gov. John Bel Edwards, more than $282 million in new revenue is flowing each year to Louisiana public services. School districts are the biggest beneficiaries – and especially those Cancer Alley public schools where 74% of students are BIPOC.

But an executive order is what made these reforms possible, and Bel Edwards will be termed out of office at the end of 2023.

Read all about it at: “Reparative Tax Policy: Racial Justice on the Line in Louisiana.”

See also:

Volume 1, Edition 1: “How Economic Development Subsidies Transfer Public Wealth to White Men”