The idea of pivoting to a world powered by clean energy, where more life-saving drugs are affordable, and workers share in the fruits of their labor, is exciting.

Those are the promises of the Inflation Reduction Act, which was signed a year ago this week.

Buoyed by hundreds of billions of dollars in federal subsidies, manufacturing companies are eagerly opening up shop and expanding in our communities, promising prosperity, “synergy,” and to be the “catalyst” for a greener new future.

But they won’t be bragging about taking massive taxpayer handouts while pulling down wages and undermining working families. They’ll be touting new jobs, sure, but refusing to sign anything that binds them to providing their workers living wages, medical and dental care, or paid days off.

This isn’t how it has to be.

Fortunately, states and communities can take action to ensure this pivotal moment doesn’t turn into another boondoggle for the One Percent.

As the IRA approaches its first birthday, here’s what we’re thinking about:

45X: The Advanced Manufacturing Production Credit, also called 45X for its section in the Internal Revenue Code, gives electric vehicle battery producers massive subsidies based on kilowatt hours.

That Uncle Sam is hitting the gas pedal, er, accelerator pedal, for clean transportation is a huge plus, and 45X requires components to be produced in the U.S. (or territory).

On the minus side, however, the IRA has no requirements for these massively subsidized companies to do good by their production workers. There are no market-based wage or benefit requirements, nothing that mandates company leaders to pay workers a wage to support themselves or their families – even though the 45X credit on its own is enough to completely cover these companies’ capital investment costs and their total wage bill for the first several years of production.

My colleague Jacob Whiton wrote about this in greater detail. Give it a read.

Recommendations: States and local governments should demand more from battery makers seeking economic development subsidies. Production worker wage requirements should set a floor at market rates – and not “averages” artificially inflated by executive salaries.

ALL tax credits and exemptions, grants, and loans, should be performance-based, so that companies either don’t get their subsidy until they deliver or they have clawbacks or money-back guarantees if they fall short on jobs, wages or investment.

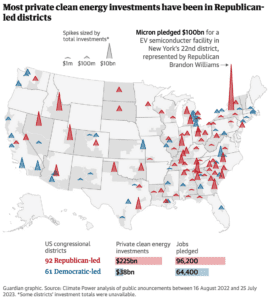

Location, location, location: The IRA doesn’t require companies to locate in, for example, historically neglected communities or in towns that once had a robust manufacturing base. But electric vehicle companies are clearly favoring the South, as this graphic from The Guardian shows:

There is Volkswagen in Chattanooga, Tenn.; BMW in Spartanburg, S.C.; Nissan in Canton, Miss.; Toyota in Georgetown, Ky.; Hyundai in Bryan County and Rivian in Morgan County, Georgia; and VinFast in Chatham County, N.C.

All six of these are right-to-work states, where workers’ rights, pay and, protections are fewer. All of these also have no state minimum wage above the federal minimum wage of $7.25 – which despite soaring housing, energy, and food costs, has remained untouched since 2009.

Recommendations: Auto jobs have long been a path to middle class lives. Rather than degrading those jobs and making it more difficult for workers to engage in collective bargaining, states and localities should:

Recommendations: Auto jobs have long been a path to middle class lives. Rather than degrading those jobs and making it more difficult for workers to engage in collective bargaining, states and localities should:

- cap EV and battery-plant subsidies at $35,000 per job;

- attach robust Job Quality Standards that ensure at least market-rate wages and benefits (with living-wage floors), tied to inflation;

- use the federal subsidies to reduce the burden on local residents – for every dollar a car’s manufacturing is subsidized by state or local incentives, subtract a dollar from the federal purchase credit (or from any applicable state credit or other inducement);

- focus on helping incumbent workers and communities currently dependent upon internal-combustion engine vehicles retool and adapt.

Read my colleagues’ report on EV subsidies for more details.

Internal Revenue Code Section 6103: This is the IRS rule that says income tax returns are secret. For many provisions of the IRA, like 45X, which are structured as “as of right” tax entitlements, we believe there will be no public record of how much any specific factory or company gets in federal tax credits.

Companies will get billions in tax breaks and the public won’t be able to see how much they got and what their part was in achieving the goals the IRA laid out: cleaner air to breathe, safer water to drink, well-paid workers taught the skills new industry jobs will require.

We urge the Biden administration to promise that all IRA tax credits will be fully disclosed on a facility-specific basis. Otherwise, it is inevitable that the spoils will go to a few powerful corporations, mimicking the failures of our current economic development policies and further fueling inequality.

Recommendations: The government must make tax credit subsidies as available as records of loans or grants.

There’s a lot to track in the years and months ahead but what’s driving our work is a basic question: What do you, me, and our neighbors get for the money we’re giving mostly to massive multinational corporations?

The IRA may have fallen short when it came to mandating facilities pay workers market-based, family supporting jobs. But communities are agitating for better, and we can get there, working together.

Here’s just one example. In Georgia, workers at electric bus builder Blue Bird voted to join the United Steelworkers. They sought higher pay, a more consistent schedule, and sick pay, among other things, according to the Associated Press.

Blue Bird, which sells its buses across the country, is in line for upwards of billions of dollars in taxpayer funds through the IRA, as well as the federal infrastructure bill.

It was a huge victory in a state with low union density.

The next battle will be getting the first contract (workers say company management has already begun retaliating).

The IRA is smart policy to help shift the country to a green economy. Maybe by its second birthday, we can celebrate a national project(s) that also creates good jobs, healthy neighborhoods, and thriving communities.

Happy birthday, IRA!