Summary

Big political contributions from law firms earning transaction fees on IDA deals may fuel more and larger corporate subsidies. Two of upstate New York’s most politically active law firms – Harris Beach, PLLC and Hodgson Russ, LLP – made the bulk of their campaign contributions to candidates for state or local office or local party committees within the boundaries of nine of the state’s biggest Industrial Development Agencies (IDAs), where they also serve as the IDAs’ transaction or bond counsel. In this role as “deal counsel,” the firms earn tens of millions of dollars a year in fees from IDA subsidies to businesses.

In these transactions, the law firms represent the IDA, but are paid a fee by businesses receiving IDA tax abatements or financing. Those fees are not generally disclosed, but appear to equal one-third of a percent or more of the value of the tax abatement. Because such fees are tied to the number and size of subsidy deals, the law firms make more when an IDA gives away more tax dollars.

Thus, like the IDAs themselves, the politically influential law firms have a financial incentive to encourage elected officials and IDA boards to abate local tax revenue that would otherwise support schools, parks, libraries, and public safety. Our recent report, “Perverse Incentive: How New York’s IDAs Depend on Giving Away Tax Dollars” showed that deal fees generate 80% of the budgets of the state’s 107 IDAs and thereby incentivize IDAs to make subsidy deals.The costs are enormous: In 2021 alone, tax abatements – mostly through IDAs – cost NYS schools $1.8 billion.

Key Findings for the Six-Year Period 2017 to 2022

Campaign contributions from law firms correlate geographically with where the law firm is hired as an IDA deal counsel. The vast bulk of political contributions made by law firms Harris Beach, PLLC and Hodgson Russ, LLP were within the boundaries of nine IDA districts where they are the IDAs’ deal counsel, including:

● 84% of all NYS contributions by Harris Beach ($657,000)

● 87% of all NYS contributions by Hodgson Russ ($153,000)

Being an IDA deal counsel is lucrative. From 2017 to 2022, the nine IDAs:

● Signed subsidy deals for projects worth $42 billion.

● Collected IDA fees from the deals worth $85.6 million, a small portion of which was

paid to law firms in disclosed fees.

● Generated another estimated $29 million to $39 million in undisclosed transaction fees

for their deal counsels.

Policy Recommendations

1. Eliminate the perverse incentive IDAs have to give away tax revenue by making IDA

local government agencies funded by general revenue within the local budget.

2. Require all fees to deal counsels be paid directly (and disclosed fully) by the IDA, not the

applicant company.

3. Require IDAs to disclose deal counsel fees on each transaction to the Authorities Budget

Office (ABO) within 15 days of each deal’s closing.

4. Forbid IDAs from abating property taxes that would otherwise go to schools.

Background/Scope

For this report, we assessed nine prominent New York IDAs (Albany County, Erie County, Monroe County, Nassau County, Onondaga County, Orange County, Suffolk County, Westchester County, City of Yonkers). New York has 107 IDAs, but we chose to look at these nine because they are among the most active outside of New York City.

We focused on the amount that deal counsels earn from the projects that IDAs enable. Transaction or bond counsels are the law firms that facilitate the deals that IDAs award. Their largest fees are not typically paid by the IDAs themselves, but rather by the applicant companies, and often their fees are a portion of what is funded by taxpayers for the project (i.e., the abated taxes). Although they are paid nominally small percentages (often around one-third of 1% of the total project cost), these fees add up to millions of dollars per year, making it a lucrative trade. There is almost no transparency around these fees, making the exact amounts hard to pin down.

From our sample of nine active IDAs, we saw two law firms show up repeatedly as deal counsels: Harris Beach, PLLC and Hodgson Russ, LLP. Although there are other law firms acting as IDA deal counsels throughout the state, these stand out as two of the farthest-reaching and most influential. Each IDA we sampled had either Harris Beach or Hodgson Russ as their deal counsel at some point, or for the entire period between 2017 and 2022. Harris Beach was reported to be the bond counsel for up to 30 IDAs statewide, while Hodgson Russ boasts of its involvement in deals throughout the state on its website.

Our previous study, “Perverse Incentive: How New York State’s IDAs Depend on Giving Away Tax Dollars,” found that IDAs are funded primarily from deal fees, giving them an incentive to award more and bigger tax abatements for their own institutional benefit, even those that may not be necessary or beneficial for their community. Transaction and bond fees are structured similarly, and since law firms are paid based on the size and number of projects an IDA awards, they too are incentivized to prioritize themselves rather than the community.

Campaign Contributions

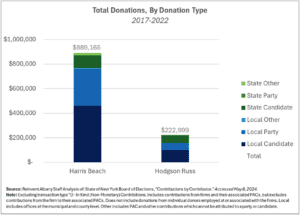

Both Rochester-area Harris Beach and Buffalo-based Hodgson Russ are very large contributors to state and local candidates and political party committees. The two firms donated a combined $1.1 million in New York during the six years from 2017-2022 – not including contributions to federal office. We estimate about 82% of their contributions went towards local candidates and

municipal or county party accounts (See Figure 1).

Figure 1. Total Donations, by Donation Type, 2017-2022

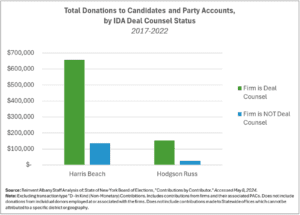

But the two firms did not spread their contributions around candidates and parties. Contributions went disproportionately to candidates and parties representing areas where Harris Beach and Hodgson Russ serve as IDA deal counsels. For Harris Beach, about 84% of all local contributions went towards those areas where the firm was an IDA deal counsel. For Hodsgon Russ, this was a similarly high 87% (See Figure 2). Importantly, some of the local elected officials benefiting from these contributions in turn appoint IDA board members, who have the legal power to grant subsidies. (The report did not look at contributions from recipients of subsidies to the elected officials who appoint IDA boards, but this should be scrutinized.)

Figure 2. Total Donations to Candidates and Party Accounts, by IDA Deal Counsel Status, 2017-2022

For reference, New York State had 107 IDAs as of 2021. Had both firms evenly spread their contributions across the state, we would expect just 8.7% of their combined $959,000 in contributions to be made in the nine IDAs analyzed (See Appendix A: Methodology). Instead, these firms contributed nearly 10 times that share towards candidates and parties tied to the IDAs where they were deal counsel.

Deal Fees

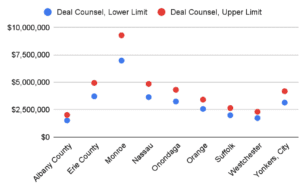

We estimate that from 2017 to 2022, for the nine IDAs that we considered, between $29 million to $39 million was paid to deal counsels as transaction fees. This range was determined by the fee schedules that some IDAs publish, the deal fees that IDAs themselves collect, and the project costs published by the ABO, as specified in Appendix A: Methodology.

IDAs are required to be transparent about the amount they give to contractors through their publicly-available reports published by the ABO. But this disclosure requirement does not apply to deal counsel closing fees, because they are usually paid directly from the applicant companies to the law firms. We think this is a critical transparency gap, and recommend that IDAs be required to disclose these fees by transaction.

Figure 3. Estimated Range of Fees Paid by Businesses Applying for Subsidies in Nine IDA Study Area, 2017-2022

Based on IDA fee schedules and fees disclosed to the ABO’s PARIS database, we can deduce that deal counsels were paid millions of dollars from businesses receiving subsidies (See Figure 3). In Monroe County alone, we estimate that deal counsels earned between $6.9 million and $9.2 million over the six years we analyzed. The Monroe County IDA specifies that deal counsels typically get one-third of the closing fee that IDAs collect, and the IDA routinely approves massive projects, including a recent $63.4 million tax abatement for a factory owned by Coca-Cola.

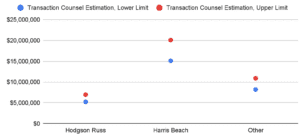

Figure 4. Estimated Earnings from Law Firm Deal Fees at the Nine IDAs, 2017-2022

Figure 4 breaks down the deal fees by law firms. Harris Beach was the deal counsel at four different IDAs, and was paid, we estimate, between $15 million and $20 million by them in the specified six years. Hodgson Russ was listed as the only deal counsel at two different IDAs, and got an estimated $5.2 million to $6.9 million in this time frame. All of the nine examined IDAs used either Hodgson Russ or Harris Beach as their deal counsel at some point between 2017 and 2022, but three of the IDAs used several different firms during this time. For those three IDAs, we did not disaggregate the deal fees by counsel, but instead categorized their deal counsel as “Other,” although this includes payments for both Harris Beach and Hodgson Russ.

Because of the lack of transparency and deal data disclosed, our estimates are not complete, but it is clear that deal counsels are making millions. Procurement reports show that these nine IDAs directly paid either Hodgson Russ or Harris Beach $1.6 million in this same six-year time frame – above and beyond the corporate-paid fees we estimate here.

Appendix A: Methodology

Estimation of Deal Counsel Earnings

From our close reading of IDA-reported spending data to the Authorities Budget Office (ABO), for the 107 IDAs throughout the state we found that the average transaction counsel agreement pays one-third of the amount that the IDAs collect in deal fees. There is no statewide schedule or prescription for the amount that IDAs may collect in deal fees or the amount that legal firms collect as transaction fees, nor any transparency on the latter. As a result, we were only able to estimate the amount that these legal firms are collecting in deal-closing fees.

Using the ABO’s “Industrial Development Agencies Summary Financial Information” dataset, we were able to compile the amount each IDA collected in deal fees from 2017-2022. The lower end of our estimation is defined as one-third of the amount that the IDAs collected.

A handful of the nine sampled IDAs publish their fee schedules, including the amount that deal counsel specifically are paid. For those four IDAs, we used their formulas, along with the “Industrial Development Agencies Project Data” dataset published by the ABO, to estimate the amount that counsel would be paid. Although the ABO does not verify the accuracy of the data, we believe that this method is the best available in trying to determine the amounts that transaction or bond counsels earned.

In our analysis, we did not see an instance of the deal counsel making less than one-third of the IDA’s deal fees; hence the lower limit of our estimates. We saw estimates of project fees as high as 1.8 times that one-third rate; they averaged 1.25 times larger. Therefore we set the upper limit of our estimates at 1.33 times the lower limit, although we consider it to be a soft limit as we are unable to run formulas for all nine IDAs.

Campaign Finance Contributions

We used the State of New York Board of Elections “Contributions by Contributor” data as of May 8, 2024. We filtered this data to contributions by “Harris Beach” and “Hodgson Russ,” which also captured the two firms’ associated PAC accounts. Note however that New York State does not require individual contributors to disclose their employer. Therefore, we currently do not know the value of campaign contributions made directly by employees of Harris Beach and Hodgson Russ. This means the total contributions from the two firms and their partners and employees is probably much higher.

As a conservative estimate, we excluded contributions which are non-monetary, type “D – In Kind (Non-Monetary).” For each contribution, we categorized if the transaction went to a candidate, party account, or other entity (such as a PAC). We then categorized if these were statewide contributions (such as to the Governor or a statewide elected judge), or can be attributed to a locality. Such contributions include municipal or county level candidates and party accounts, or State Assembly or Senate representatives.

To associate an electoral locality to an IDA, we analyzed the area field included in the contributions data. For municipal and county contributions, these are already flagged in the data, and we created an additional indicator for if the firm was IDA transaction counsel at any point during our analysis period. For state candidates, we overlaid Assembly and Senate districts over county and municipal IDA boundaries using GIS, and indicated if any candidates had any area representing the IDAs used in our analysis.

Appendix B: Summary Chart

| IDA | Transaction/Bond Counsel | Deal Fees Collected by IDA | Total Tax Abatements Awarded | Transaction Counsel Fees, Low Estimate | Transaction Counsel Fees, High Estimate | Harris Beach Campaign Contributions | Hodgson Russ Campaign Contributions |

| Albany County | Hodgson Russ | $4,551,603 | $439,558,176 | $1,517,201 | $2,017,877 | $0 | $18,699 |

| Erie County | Hodgson Russ | $11,145,942 | $4,468,774,014 | $3,715,314 | $4,941,368 | $79,850 | $134,643 |

| Monroe County | Harris Beach | $20,944,855 | $11,054,732,567 | $6,981,618 | $9,285,552 | $206,609 | $4,500 |

| Nassau County | Hodgson/Other | $10,940,895 | $6,767,842,359 | $3,646,965 | $4,850,463 | $185,100 | $0 |

| Onondaga County | Harris Beach | $9,735,972 | $2,531,297,737 | $3,245,324 | $4,316,281 | $56,650 | $0 |

| Orange County | Harris Beach/Other | $7,699,546 | $2,407,953,431 | $2,566,515 | $3,413,465 | $9,500 | $0 |

| Suffolk County | Harris/Nixon/ Barclay | $5,968,163 | $3,190,115,811 | $1,989,388 | $2,645,886 | $148,455 | $0 |

| Westchester County | Harris Beach | $5,204,072 | $8,520,698,743 | $1,734,691 | $2,307,139 | $29,300 | $0 |

| City of Yonkers | Harris Beach | $9,438,197 | $2,792,808,634 | $3,146,066 | $4,184,267 | $22,100 | $0 |

Related: “Perverse Incentive: How New York State’s IDAs Depend on Giving Away Tax Dollars”