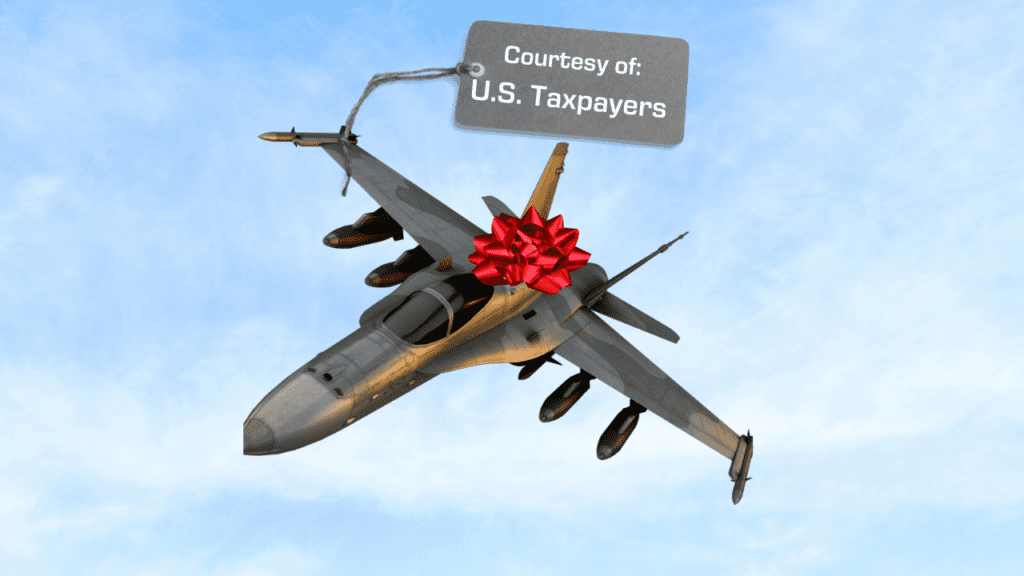

War is good for the weapons business. New and continuing conflicts in Eastern Europe and the Middle East are driving record profit projections for aerospace and military contractors. While some employers, universities, Congress, and the White House are debating the best ways towards peace, those debates have omitted the biggest financial beneficiaries of these conflicts: arms manufacturers. Not only do these military outfitters benefit from weapons purchases around the world, but they also receive millions of dollars in subsidies from state and local governments to produce them.

U.S.-based firms Lockheed Martin and RTX (formerly Raytheon and United Technologies) are two of the leading arms sellers worldwide. The federal government contracts with these businesses to produce missiles, fighter planes, and other military technology. Last month alone, Lockheed Martin Corporation received over $1.1 billion in government contracts. Moreover, on an earnings call in October, the CEO of RTX implied that Israel’s need for air and missile defense systems would be advantageous to the company’s bottom line once contracts from the U.S. Department of Defense (DoD) came through.

Arms dealers don’t just profit from the federal government. State and local governments also routinely use taxpayer dollars to issue economic development grants and tax breaks to support the production of equipment, often without proper disclosure as to the costs of tax credit programs. For example, Florida spent an “undisclosed” amount on Lockheed Martin’s highly-demanded guided missile defense systems from 2015 to 2018.

In the event that subsidy amounts and recipients actually are disclosed, they reflect an abhorrent spending trend caused in part by the arms industry’s capture of public officials. Since 1985, the RTX Corporation has received 453 incentive awards from state and local governments, costing taxpayers more than $906 million (as well as 81 federal grants or targeted tax credits).

In general, there’s little evidence that such subsidies create jobs. Too often, governments give money to corporations to move jobs from one state to another. In some cases, they do even less. By 2024, for example, New Jersey will have spent $107 million in taxpayer dollars in a deal just to retain, not create, 250 jobs after Lockheed Martin decided to move operations from Moorestown to Camden in 2014. With a net yield of zero jobs, it becomes hard to see such deals as anything other than wasteful corporate welfare.

Arms manufacturers also routinely rack up violations for misconduct. Over the years, RTX has been fined by the DoD for selling faulty equipment, overbilling, and violating export controls.

Merchants of death always stand to profit from conflict abroad and US government contracts. They should be last in line to receive government handouts.

Good Jobs First has previously highlighted subsidies to firearms makers after acts of domestic gun violence. Mass shootings have set all-time records in the past four years.