Recent federal investment in advanced manufacturing and clean energy industries have led many states to revive or expand their use of research and development (R&D) tax credits. Lawmakers say that public tax breaks for innovation will spur job development, but it remains to be seen whether these giveaways to corporations will do anything other than poach companies from other states.

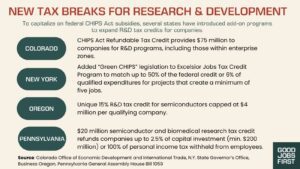

Today, 36 states offer companies tax breaks for research and development expenses. Over the past two years, at least five states have introduced new R&D credit programs that provide extra support for innovation in the semiconductor field, as a complement to the CHIPS and Science Act of 2022, even though a state match is not a requirement of the program.

The trend is not a promising one. In Oregon, for example, the R&D credit for semiconductors updates a non-industry specific credit that was discontinued due to insufficient evidence that it encouraged increased research activity. In Michigan, which is currently considering a $100 million R&D credit, state business interests are advocating for no annual cap on the credit and to receive the credit “as-of-right” without submitting an application, allowing them to claim more in taxpayer dollars and further obscure their activities.

State lawmakers who propose these incentives usually promise hefty corporate tax breaks will deliver high-quality local jobs. Indeed, research suggests that the use of R&D credits is more likely in states with manufacturing-intensive economies and relatively high unemployment. There is limited evidence that the credits create job growth, but even then, they do so at a high cost. New York’s Green CHIPS R&D credit, for example, claims to boost employment but gives away the credit after companies create just five net jobs. In most cases, reimbursements cover equipment rather than labor costs.

Even when a program includes employment requirements, the details of the tax breaks sometimes seem to undermine job creation goals. For example, Missouri’s R&D tax credit program requires eligible small businesses to hire between 20 and 40 employee. But technology companies are only required to hire 10 new employees. These differing thresholds may imply a preference for attracting certain industries and it may also impose undue barriers for start-ups and entrepreneurs.

While these programs do tend to boost in-state R&D spending, they may do so at the expense of other states. In a 2007 article on state R&D, researcher Daniel Wilson asks the questions “are these tax incentives effective in increasing in-state R&D?” and “how much of any increase is due to R&D being drawn away from other states?” His answers are “yes and nearly all.” Applied nationally, R&D credits may just be moving private investment across state lines, having an insignificant impact on aggregate spending on innovation.

Over time, credits that were initially intended to support research advancement at existing businesses have increasingly been used to lure companies from other states. Sometimes this preference appears in the law itself. In Alabama, for example, the net value of business incentives favors newer R&D firms over mature R&D firms, suggesting a preference for entrepreneurship and recruitment over expansion.

Researchers have also found that states spend more on similar incentive programs when their neighbors do. For instance, Oregon’s adoption of a semiconductor R&D credit this year comes after nearby Utah expanded its R&D tax expenditures by 20% over the last three years. If lawmakers rush to outbid other nearby states, our communities will be the losers, and state coffers depleted.

Finally, the public deserves transparency whenever the government gives away our money. Many states offer R&D tax credits “as-of-right”, which means the public will never know how many dollars in credits any company claimed, how many jobs were generated, or how well or poorly those jobs paid—because company tax filings are confidential and tax returns don’t report jobs or wages. Greater accountability around R&D credit recipients will help ensure they actually promote innovation and generate good jobs in growing science and technology sectors—not just award corporations another tax holiday.