In 2015, hundreds of transparency advocates (mostly organized by us, we later admitted) scored a huge victory with the adoption of a new accounting rule that requires state and local governments to report how much revenue they lose to economic development tax abatements.

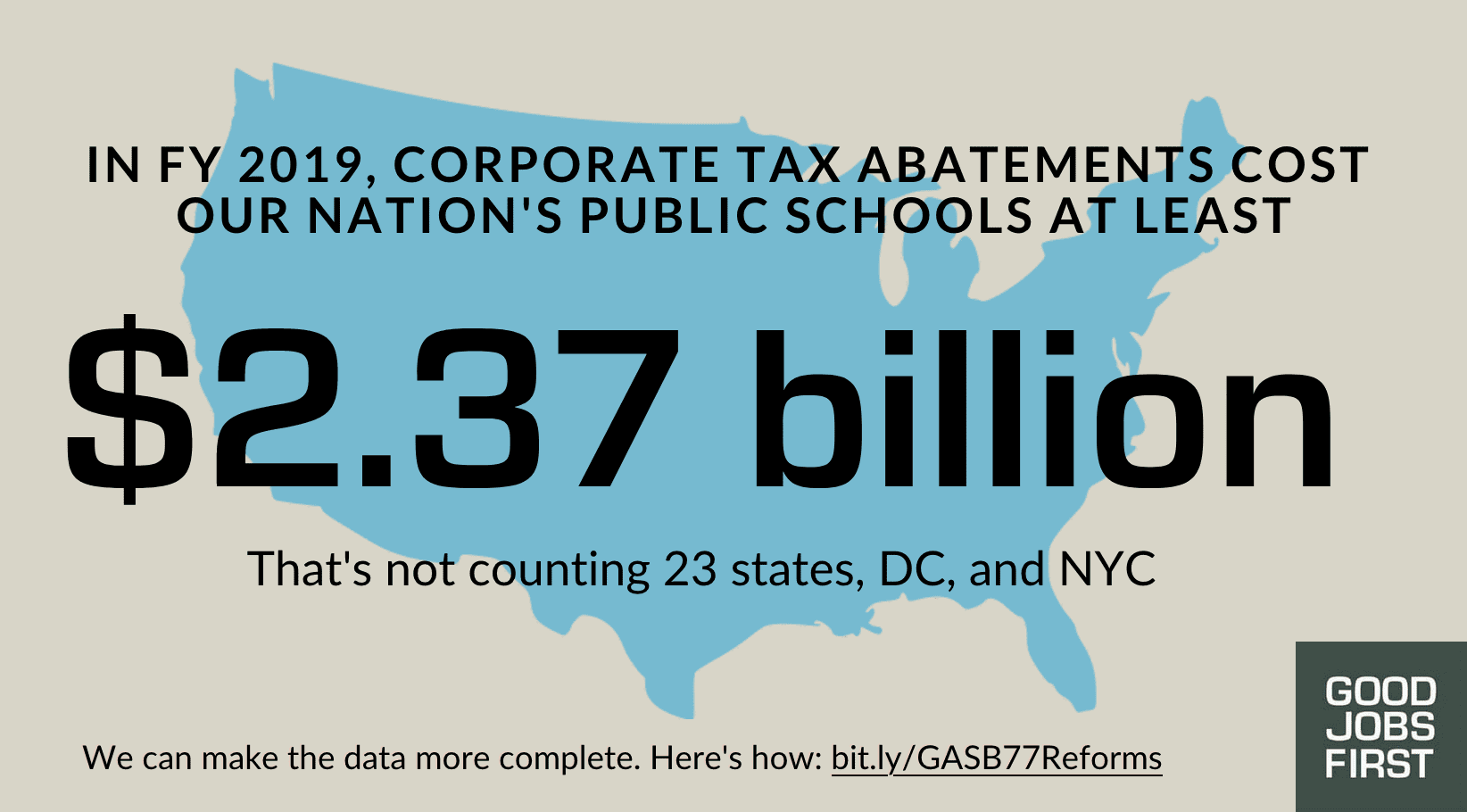

For the first time in any comprehensive way, the public could learn how much money they were foregoing in the name of economic development — especially property tax revenue so critical for schools and public health.

But as promising as this milestone is, there remain significant deficiencies: compliance is uneven, and the intended data is too often missing or misleadingly reported. We at Good Jobs First think the rule, Governmental Accounting Standards Board (GASB) Statement No. 77 on Tax Abatement Disclosures, could be much stronger.

Good Jobs First Policy Coordinator Christine Wen, who leads our work on GASB 77, and Executive Director Greg LeRoy, offer eight suggestions for how GASB can strengthen the rule to ensure better compliance and reporting right now.

For example: we argue that all tax increment financing (TIF) diversions should be fully disclosed. And in states that use a gimmick to dodge their constitutional ban on “gifts and gratuities,” tax abatements should be clearly classified as such.

With broader, clearer direction from GASB, more communities can accurately report how much revenue they’re foregoing in the name of economic development incentives. Armed with that information, residents can decide if they’re worth it.

Read their recommendations here.

Send comments, suggestions, or questions to Wen at [email protected] or LeRoy at [email protected].