Key Reforms: Overview

When economic development subsidies are used to subsidize activity in the private sector, companies and public officials must be held accountable for creating family wage jobs and other community benefits. Good Jobs First works with organizations and public officials across the country to reform economic development practices and subsidy laws. The Key Reforms described here are a compilation of the best practices developed and implemented nationwide.

With the exception of traditional community benefits agreements, the best practices we advocate are legislative (and sometimes administrative) reforms. The advantage of a legislative approach is that activists don’t have to stage a fresh site fight each time a new development deal is proposed. Instead, every deal enacted in that region or under that subsidy program must adhere to the accountable development standards contained in the law.

This does not let citizens off the hook, however. An organizing approach is required to get public officials to take action, both in passing reforms and ensuring that they are properly enforced. Such an approach requires the involvement of community groups, unions, religious organizations, environmentalists, budget watchdog groups, public officials, and others.

Below are some common-sense reforms, many of which are already on the books in some states and cities. Click on the reform name for a more detailed description.

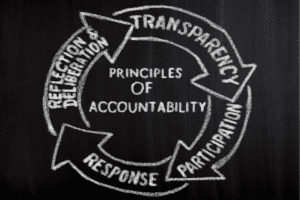

Reform #1: Require Disclosure of Subsidy Spending and Company Compliance

Disclosure laws require states to release company-specific information on the type and amount of subsidies they grant, the benefits companies have promised to create, and the track record of companies in complying with those obligations. The availability of complete, accurate, and timely information on the costs of subsidies and on compliance allows public officials and citizens to evaluate whether subsidies are a good investment of taxpayer dollars.

Disclosure laws require states to release company-specific information on the type and amount of subsidies they grant, the benefits companies have promised to create, and the track record of companies in complying with those obligations. The availability of complete, accurate, and timely information on the costs of subsidies and on compliance allows public officials and citizens to evaluate whether subsidies are a good investment of taxpayer dollars.

Reform #2: Enact and Enforce Money-Back Guarantees on Subsidies (“Clawbacks”)

Clawbacks, also called recapture provisions, are clauses in subsidy laws that require a company to return all or part of the value of a subsidy if the company fails to meet the obligations agreed to as a condition of receiving the award.

Reform #3: Ensure that Subsidized Companies Create Quality Jobs

Job quality standards are requirements that subsidized companies create full-time positions paying livable wages and/or providing health insurance and other benefits. Wage and benefit requirements enable government to avoid what is in effect a double subsidy: the cost of direct economic development aid as well as the cost of social support programs such as Medicaid and food stamps needed by low-wage employees to make ends meet.

Reform #4: Protect Schools from Tax Giveaways

Reform #4: Protect Schools from Tax Giveaways

Property tax abatements are among the largest and longest-lasting subsidies companies receive, and they can be devastating to the budgets of local schools. We can protect education from tax giveaways by giving school boards veto power over the use of tax-increment financing and other subsidy programs that impact their budgets.

Reform #5: Increase Accountability in the Subsidy Approval Process

Increased citizen input in the subsidy award process means that decisions are no longer made solely by corporate executives and development officials. Holding well-publicized public hearings (at reasonable times) on proposed subsidy deals allows citizens to weigh in before decisions are made. Requiring every subsidy deal to be voted on by elected bodies allows citizens to hold their representatives accountable for making wise choices that create real benefits with economic development dollars.

Reform #6: Keep State Tax Policy out of the Subsidy Debate

Companies have become adept at lobbying states for tax code changes that benefit their local business interests. They often use the threat of relocating or expanding elsewhere to pressure state governments to lower business taxes, thus forcing states into a disastrous tax-reduction competition. The result is a decline in public services, a shift in the tax burden to individuals, or some of both.

Reform #7: Negotiate Community Benefits Agreements with Developers

Community Benefits Agreements (CBAs) are legally binding contracts between two private parties — developers and community-labor coalitions — to ensure that major development projects benefit local residents. Benefits are negotiated individually for each deal to fit the needs of community groups, and often include first-source hiring, living wages, and affordable housing assistance. The agreements are then incorporated into the city or county development agreement, so that they are doubly enforceable by both citizen groups and local governments.

Community Benefits Agreements (CBAs) are legally binding contracts between two private parties — developers and community-labor coalitions — to ensure that major development projects benefit local residents. Benefits are negotiated individually for each deal to fit the needs of community groups, and often include first-source hiring, living wages, and affordable housing assistance. The agreements are then incorporated into the city or county development agreement, so that they are doubly enforceable by both citizen groups and local governments.

Reform #8: Target Subsidies in Ways that Promote Smart Growth

Subsidies often contribute to sprawl, which harms working families. There are a number of ways that subsidies can be used to promote smart growth, including tying subsidies to transit, denying subsidies to retail, and instituting affordable housing requirements.

Reform #9: Anti-Poaching Agreements/Anti-Piracy Rules

Also known as anti-piracy or anti-raiding agreements, these are pacts between states or localities to forgo the use of subsidies to lure companies from one another’s jurisdictions. Anti-piracy provisions also exist in some federal subsidy programs but need to be expanded and enforced more aggressively.

Reform #10: Ban Non-Disclosure Agreements

Too often, the public is left out of discussions involving the use of economic development subsidies because companies force elected leaders to sign non-disclosure agreements. Our solution is simple: States and cities should ban officials representing the public – be they elected leaders or heads of economic development departments – from signing NDAs with corporations.

Too often, the public is left out of discussions involving the use of economic development subsidies because companies force elected leaders to sign non-disclosure agreements. Our solution is simple: States and cities should ban officials representing the public – be they elected leaders or heads of economic development departments – from signing NDAs with corporations.