Record profits don’t stop the giving

Amazon.com crosses $3.7 billion threshold in taxpayer subsidies, Good Jobs First finds

Washington, DC — State and local governments gave Amazon.com subsidies totaling more than $3.7 billion as it grew to become one of the world’s largest companies, according to an update released today by Good Jobs First, the national watchdog group on corporate tax breaks.

The figure doesn’t tell the whole story, as the company has gotten increasingly effective at hiding the full costs of its subsidy packages. At the same time, some of the communities giving away big packages have had to make budget cuts or raise taxes on working families and small businesses.

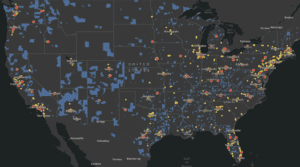

Most of the deals are for Amazon’s rapidly expanding retail business: warehouses large and small. But taxpayers have been subsidizing every aspect of the company’s sprawling operations: offices including HQ2, data centers, Whole Foods grocery stores, Zappos warehouses, the company’s movie and television productions—even a fashion studio in New York City.

The list includes direct cash assistance, free land, reduced electricity costs and hundreds of millions in income, sales and property tax breaks.

- Explore the giveaways: goodjobsfirst.org/amazon-tracker

“Amazon’s Prime business model, based now on rapid delivery and massively benefiting from the pandemic, requires it to build hundreds of new warehouses,” said Greg LeRoy, Good Jobs First executive director. “Why should taxpayers pay a company to do what it must do anyway?”

“Those who lose the most to corporate giveaways are local residents: these deals mean there is less money for schools, roads, infrastructure, and public health,” said Good Jobs First Research Analyst Kasia Tarczynska, who maintains Amazon Tracker. “But in the case of Amazon, it is also small businesses who are getting shortchanged even though the pandemic is hurting them the worst.”

- Read Tarczynska’s blog about what can be done to curb Amazon (spoiler: we all have a role, even Amazon itself).

Since 2016, Good Jobs First has been tracking how much taxpayers have given to grow Amazon’s empire. The pandemic, which cut revenue sharply for states and cities, didn’t stop Amazon from seeking government handouts: So far in 2020 alone, Good Jobs First found the company has been approved for at least 12 deals totaling approximately $146 million in state and local subsidies, and continues to reap the benefits of tens of millions in savings provided for in previously inked multi-year agreements

That’s as the pandemic boosted Amazon’s founder Jeff Bezos’ personal fortune by nearly 80%, or $90.1 billion: His net worth now exceeds $200 billion.

The new $3.7 billion total is conservative and incomplete. Since Good Jobs First released its first investigation into Amazon’s subsidies in 2016, the company has prevailed upon some governments to obscure the full value of some new deals. In some cases, officials refuse outright to say how much a deal is worth, as was the case when Amazon got sales and use tax exemptions for its five data centers in Virginia, or states fail to disclose the value of specific, long-term utility tax breaks granted to Amazon data centers.

But consider how that money could have been spent in recent years:

- In Suffolk County, New York, Amazon got $2.3 million in tax breaks for a distribution center. This amount could have helped save bus routes , or boost funding for mental health, domestic violence and gang prevention programs, all on the chopping block in the upcoming budget.

- Officials in Deltona, Florida , gave $2.5 million in tax rebates for a distribution center, even as they raised property taxes by nearly 10% and cut recreational offerings.

- In Greenfield (Hancock County), Indiana, non-public safety employees had to forego raises this year as officials gave Amazon 10 years of tax breaks worth an undisclosed amount for a distribution center. The state kicked in another $4.3 million.

In addition to the diversion of money for public services, most outcomes aren’t tracked over time for the public to see what benefits taxpayers got in return. And as Good Jobs First mapped out earlier this year, Amazon locates its warehouses near transportation arteries and near neighborhoods with lots of affluent Prime customers, making the subsidies senseless. State and local taxes are microscopic cost factors that rarely determine where a company expands or relocates.

To put taxpayer dollars to better use, Good Jobs First recommends the following, at a minimum:

- Making e-commerce facilities ineligible for incentives

- Require instead that e-commerce facilities agree to Community Benefits Agreements such as direct employment (no use of staffing agencies), living wages and benefits, locations with frequent transit access or employer-provided shuttles to transit, and Covid hazard pay reinstated

- Making retail facilities ineligible for incentives unless they are bringing basic retail amenities to demonstrably under-served areas, such as bringing a grocery store to a food desert

- Making companies above a certain size ineligible for incentives because they already have access to capital, management depth, market share, etc.

- States and localities must embrace Governmental Accounting Standards Board Statement 77 on Tax Abatement Disclosures, a new accounting rule that requires most governments to report how much revenue they lose to tax break programs

Big corporations are the biggest winners when it comes to subsidies. Let’s level the playing field to ensure limited economic development investments go to areas that truly need them and small businesses that grow local economies and livelihoods.

Good Jobs First, based in Washington, DC, is a non-profit, non-partisan resource center promoting accountability in economic development. It also maintains Subsidy Tracker, a database that reveals where corporations get taxpayer assistance.